What are financial KPIs for fast-growing medium businesses?

Key Performance Indicators (or KPIs) are a method of distilling the performance of a business into a few very precise metrics to allow executives and managers to see what is happening at a glance.

Discover what are the KPIs any growing business should track in order to accelerate their growth. Continue reading for more details.

Often, you will see KPIs touted as template or standard type KPIs but we’d caution against this approach because what is good for one business may be completely wrong for another.

Instead, it is far better to produce your own set of KPIs that perfectly match your organisation and the way it works and as we’ll explain later there are other benefits to producing them too.

In this article we are looking at;

- What are financial KPIs?

- Why are financial KPIs important for medium businesses?

- Key financial metrics for business growth

- Tools and software for tracking KPIs

- Case Study: Medium businesses using financial KPIs

- The impact of measuring the right KPIs on business growth

What are Financial KPIs?

Financial Key Performance Indicators are, as the name suggests, financial metrics for monitoring business performance.

They focus on financial performance and ideally should be as close to real-time as possible to make them useful.

The important word here is ‘Key’.

A key performance indicator has to be something that;

- Relates directly to an aspect of business performance

- Has a lever attached that a manager can use

- Is measurable

- Is specific

- Is related to an objective or goal of the business

Above all, make sure that when you choose a KPI it really does relate to something that is valuable to your organisation. Avoid including things that people say you ‘should’ have in your reporting.

But what are some non-financial KPIs?

Non-financial KPIs are exactly the same as financial KPIs but with the focus shifted to operational (or other) metrics. To allow effective reporting they still have to be expressed numerically, but they won’t be looking at financial outputs.

Typical non-financial KPIs for a growing business might be;

- Customer acquisition rate

- Number of days stock held

- Customer-to-staff ratio

- Website conversion rate

Again, it is important to choose non-financial KPIs for your business rather than repurposing ones that are used elsewhere.

Why are Financial KPIs important for medium businesses?

One thing that tends to characterise medium businesses is that they run lean.

This means that they are not overburdened with analysts and business partners which in turn means that managers need clear, unambiguous information to enable their decision-making process.

KPIs give the status of projects, departments, service lines or the business as a whole at a single glance. This means that, with well-chosen KPIs, delivered quickly managers can speed up the decision-making process giving the organisation a competitive advantage.

There’s another really important benefit of a KPI setting project and this is that in order to set a KPI you must first completely understand what is driving the business, how it works and what the challenges are.

This increased business knowledge is invaluable and can lead to further efficiencies as an indirect result.

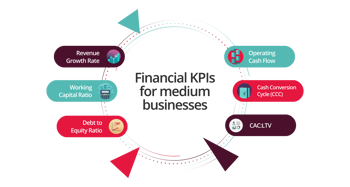

Key Financial Metrics for Business Growth

Understanding the key financial metrics is crucial for driving business growth. As we noted above, every business is different so some of these may not apply to your business but as a general guide, there are some common KPIs we see in growing businesses.

Revenue Growth Rate

Revenue Growth Rate measures the increase in sales over a period, indicating market demand and expansion.

For a growing company, the revenue is not necessarily important but what is key is the rate it is growing at. If you are attracting more customers then your company should naturally grow and become more profitable.

Working Capital Ratio

Working Capital Ratio reflects a company's short-term liquidity, showing its ability to cover current liabilities with current assets.

In other words, the working capital ratio shows how easily the company can pay its bills when they become due. This is closely linked to operating cash flow below.

Debt to Equity Ratio

Debt to Equity Ratio assesses financial leverage, indicating the proportion of debt used to finance operations compared to shareholders' equity.

This is important because if a company is carrying too much debt (over-leveraged or exposed) then it could be spending a lot of cash servicing the debt leaving little for shareholder dividends and growth.

Operating Cash Flow

Operating Cash Flow reveals the cash generated from core business activities, essential for sustaining operations.

The key maxim of “Businesses don’t die of lack of profit only lack of cash” applies here.

Cash Conversion Cycle

The Cash Conversion Cycle tracks how long it takes for a company to convert investments in inventory and other inputs into cash flows from sales.

An example here would be where a company is holding way too much stock which would increase the conversion cycle.

Cost of Customer Acquisition to Lifetime Value Ratio

Cost of Customer Acquisition to Lifetime Value Ratio (CAC:LTV) compares the cost of acquiring a customer to the revenue they generate over time, essential for assessing profitability and scaling potential.

If you assess the cost of customer acquisition on its own then you could be mistaken in believing that it is expensive. However, if it costs £500 to acquire a customer and the average person spends £10,000 over the next 3 years then it is a bargain.

Explore more resources on how to take advantage of your financial data

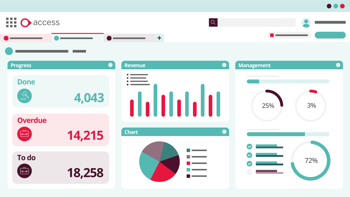

Tools and software for tracking KPIs

Let’s be honest, if you want to you can track KPIs on a piece of paper but that is probably going to take a long time, be inflexible and look quite unprofessional.

The good news is that there are lots of tools out there that will help you track your KPIs.

The most obvious starting point for tracking KPIs is Excel. We all use it and we all know it so it makes sense to build your first dashboard in the program. The downside with this is that to build a really effective financial dashboard takes a fair amount of time and knowledge and the upkeep is likely to be extensive.

Third-party apps can be very useful for tracking KPIs and they can often be linked up to systems using native APIs that allow information to transfer between the two.

That being said, you do need to set up the system, learn how to use it, make sure the APIs are in place and working correctly and monitor the link constantly. In practice, you often find that not all the APIs work properly and you end up exporting and importing data every month.

Find out more about the Reporting feature within Access Financials.

Case Study: Medium businesses using financial KPIs

How can the right finance system help your business grow sustainably?

Before implementing Access finance software, Brown & Co, a diverse business with thirty-four different income streams, needed to generate thirty-four separate reports every month. The team then had to manually merge these reports into a master spreadsheet to gain a comprehensive view of the group’s results. Since the implementation of Access Financials, the team has not only reduced the potential for manual errors in their results but also cut down the time needed to create them.

Brown & Co’s Commercial Operations, Director Alton Nutile, says:

Those reports took our assistant accountant four or five hours every month. Now it’s a two- or three-minute job. With a click of a button, we can refresh the report and see all that information straight away. It’s fantastic. So much so, that we’ve now taken the time to stop and take stock. And where we’ve created some spare capacity in the finance team, we can now do more of the analytical stuff that we should be doing instead of the administrative stuff.

Discover Brown & Co's successful journey using Access Financials.

The team at Friends of the Elderly also started to notice immediate improvements after implementing Access Financials within their organisation. This included the production of management reports. Sharon Nunn, Group Financial Controller, says:

‘We can now produce management reports in record time, from compiling all the relevant and correct information to actually completing the report. [...] 'This now takes us 3 days for all the different departments within the charity. We wouldn’t have been able to do it this quickly before – it used to take us at least two weeks to complete.'

Find out how Friends of the Elderly reduced reporting time with Access finance software.

The impact of measuring the right KPIs on business growth

Measuring the right Key Performance Indicators (KPIs) has a significant impact on business growth, as it provides clear insights into performance and guides strategic and tactical decision-making.

By tracking relevant KPIs, businesses can identify areas of strength and weakness, enabling leaders to focus on optimising resources and improving operations. The right KPIs help set realistic goals, motivate teams, and foster accountability, ensuring that efforts are aligned with growth objectives.

Moreover, they allow businesses to spot trends, respond to market changes quickly, and refine strategies. Ultimately, measuring the right KPIs promotes data-driven growth, improves efficiency, and supports long-term success.

In short, a set of KPIs well chosen and aligned with the business objectives delivers a competitive advantage.