What is a financial dashboard and what to include it in? Definition, Metrics, Examples

Sometimes you can have too much of a good thing and this is certainly true of financial data.

If it seems like you can’t see the wood for the trees then there is a good chance that a financial dashboard may help although, of course, this does beg the question; What is a financial dashboard and how do you create one that fits your business needs? Keep reading below.

Jump ahead:

Key Takeaways

In this piece, we are going to run through the theory of financial dashboards and give you some practical steps to help you produce your own.

We will cover;

- What is a financial dashboard?

- How-to create your own financial dashboard

- 6 challenges in reporting to stakeholders

- 3 Financial dashboard examples

- And much more!

What is a financial dashboard?

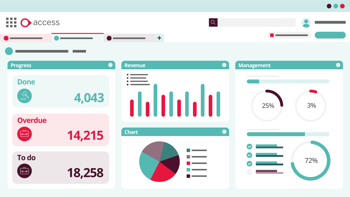

Put simply, a financial dashboard is a method of presenting critical financial data so it can be read and understood at a glance.

With operational and financial systems becoming ever more complex and the resulting information becoming even more accessible, the production of data has been supercharged.

Large amounts of data might seem like a good thing, but when an executive is trying to make a decision, sifting through reams of information can slow the process down and make it more difficult to understand what is relevant and what is not.

The dashboard may use numbers, graphics and infographics to present key information that will help users make fast decisions based on the most relevant and important indicators.

How financial dashboards help make better business decisions

Whilst there are quite a number of CEOs in the media that like to portray themselves as ‘flying by the seat of their pants’, behind the scenes you can be sure that all of the most successful entrepreneurs make data-driven decisions.

There are three simple things that data needs to inform better decision-making.

- Accuracy - there’s no value in making choices based on incorrect information as it may simply drive incorrect decisions.

- Timeliness - sales data that appears three months after the end of the month is almost worse than no data at all.

- Availability - you may have accurate data and it may be available in real-time but if nobody can get to it then it is useless.

In short, the best business decisions are made with accurate, timely data that informs the process and is reported in an easily understandable way.

What financial dashboard metrics should you include?

Arguably the skill in producing a financial dashboard lies not in the actual presentation but in understanding what you should, and should not, include.

Whilst it may be tempting to want to copy what other companies do, or to look for a template dashboard, this approach could ultimately prove to be a dead end as each organisation is different and although they may look superficially the same, the key indicators could be vastly different.

It is also true to say that the process of deciding what to show on a financial dashboard is a worthwhile one in itself as it forces people to take time to understand what makes the organisation tick.

We’ve included some items in our example dashboards but please don’t take these as ‘must-haves’. Instead, it may be worthwhile reading through our article on financial KPIs here as a way of understanding key metrics.

How to create a financial dashboard: Key components

So rather than looking at the metrics you should include, let’s take a look at the features you need to have in place to make your dashboards first-class.

Customisable financial dashboard metrics

As we have already discussed, it is not advisable to use a cookie-cutter approach to choosing your metrics so try and avoid including things just because they are easily available from your system or because you think you ‘should’ have them.

Instead, use your own customised metrics to give an individual dashboard that truly represents your organisation.

Real-time data updates and visualisation

Speed is often of the essence and with most companies using cloud-based systems, data is more readily available than ever.

Link your dashboard up to your systems in real-time so that you can refresh and get the most up-to-date information possible.

Do make sure though that the data isn’t skewed because some processes have not yet been run, for example, the bank rec hasn’t been completed or accruals aren’t yet journaled.

Accessing data from multiple sources

Following on from the previous point, it may be that your company only inputs sales data to the finance software on a weekly basis which means your reporting is always lagging.

So why not produce a dashboard that uses multiple sources?

Use financial systems for financial data and operational systems for operational data for example. That way you are more likely to get to real-time reporting and your output is likely to be richer.

Leveraging automation for streamlined processes

When we talk about waiting for accruals to be done then we are definitely missing a trick.

If you want to move your reporting on to the next level then you need to make sure that your financial processes are automated as far as possible.

Automated accruals and prepayments, bank recs, payroll data and much more can help to ensure that the base data your financial dashboard feeds from is as up-to-date as it can possibly be.

Self-service reporting and collaboration

Traditionally, the finance team produce reports on a set timetable and then distribute them to people on a set day of the week or month. This means that the finance team has to carry out a reporting process resulting in yet another manual task to add to the list.

The readers of the reporting need to be ready to receive the information otherwise what we see in practice is a large number of reports landing in inboxes and then getting buried. This means that they rarely get read.

Instead, look to provide your users with self-service reporting so that when they need information it is available at the click of a button.

Integration with existing financial systems

As we mentioned above, taking data from multiple sources means that you are more likely to get richer real-time reporting than if you confine yourself to financial systems.

But with that comes another task - getting the data from each system.

This doesn’t have to be the case, however, and using integration with APIs will save you an awful lot of cutting, pasting, importing and exporting.

Explore more resources on how to take advantage of your financial data

6 challenges in reporting to stakeholders

When you are producing financial reporting for non-financial managers then there are a number of things that you need to bear in mind.

Consider;

- Not using financial terms and jargon - make your information as user-friendly as possible.

- Using titles to add context - column and row titles can be very helpful in explaining the context behind numbers.

- Titling your graphics appropriately - graphics without titles give the reader added work to do to understand what the graph is showing before they get to understanding the information.

- Not mixing scales - don’t have one table that shows numbers in £000s and another that shows £0.

- Using consistent, understandable formats - make sure you have a clear policy on negative numbers for example. Consider using brackets and red fonts for negative numbers rather than just a black hyphen.

- Not assuming knowledge - don’t assume that because you understand a metric that everyone will. Perhaps include info bubbles to explain.

3 Financial dashboard examples

When setting up a dashboard it is vital to include the user in the development process. But bear in mind that simply asking them what they want is unlikely to prove fruitful, especially if they have never had a dashboard or are not a financial manager.

Instead, Before you set your dashboards in stone it is always a good idea to produce a type of ‘Aunt Sally’ with an example board showing what you think the user will be interested in. People find it much easier to say what they do and don’t like about an example board rather than sitting with a blank sheet of paper and trying to come up with their own metrics.

Let’s look at a few example dashboards but bear in mind our caveat about using these metrics as gospel.

1. Financial performance dashboard

As the name implies this should be focused on financial data and should include things that are important and relevant to your organisation.

Typical things we may see here might include;

- Net profitability

- Projects ROI

- Average sales value

- Net income % per person/vehicle/site

2. CFO dashboard

The CFO dashboard will likely involve financial and non-financial metrics and is likely to be focused on high-level indicators.

They may include;

- Cash balances

- Profit - gross to net

- Income by source

- Financial metrics by subsidiary

3. Cash flow analysis dashboard

There aren’t many companies that don’t have to keep a keen eye on cash flow so this is a particularly useful dashboard.

It may include;

- Cash balances by availability

- Debt facilities by availability/utilisation

- Summary aged debtors analysis

- Summary aged creditors analysis

- Loan paydown profile

Do remember though that your dashboard shouldn’t be set in stone and it is worthwhile having a review around three months after you go live.

Typically we find that users realise that perhaps a metric isn’t as useful as they thought or that there is something that they forgot to include in the original build.

Remember that as your organisation grows or changes you may need to revisit the process to include extra elements.

How to use Access Financials as your go-to tool for financial reporting

Make the most out of Access Financials to create the financial dashboard that supports your business goals. Discover valuable insights with our reporting feature to drive strategic decision-making and achieve financial success.

"What I do enjoy about the system and sort of more regularly use is analytics ensuring that the wider team at Farnborough has the information that they need at their fingertips."

AU & NZ

AU & NZ

SG

SG

MY

MY

US

US

IE

IE