What should your flexible benefits allowance be?

Getting your flexible benefits allowance right for your flexible benefits schemes can be a tricky task. Doing so however will help boost scheme uptake, retention and ensure that your employees get the most from your employee benefits package.

So, what should your flexible benefits allowance be?

Flexible benefits in a nutshell

Flexible benefits are all about choice. Flexible benefits tech allows companies to provide a broader range of benefits and employees to make the most of the benefits that matter the most to them and their families.

With a flexible benefits allowance, employees are allocated a set value which they can spend on employee benefits of their choice.

Typically, employees can either use their allowance to cover the full cost of a benefit or range of benefits or they also have the option to contribute themselves.

Employees can then tailor their employee benefit options to suit them using their allowance.

For more information on our how flexible benefits tech works, see our flexible benefits page for a complete overview.

What are your goals and objectives?

To start with, consider the goals and objectives of your employee benefits options and what your primary targets are from a HR perspective.

For example, are you prioritising increasing scheme uptake? This could present a good case for setting a higher flexible benefits allowance.

Have you recently launched a brand-new scheme?

Boosting your flexible benefits allowance for the first year of the launch of a brand-new scheme could boost the number of early adopters, which could be crucial in its long-term success.

The more employees that get involved with a new scheme in the early stages and have a positive experience, the more likely that scheme will be popular further down the line.

When launching a new scheme, allocating an extra flexible benefits allowance for employees to use at their discretion on that new scheme could go a long way.

Not only will it boost uptake, but it will show employees that you’ve not only gone to the lengths of introducing that new scheme but to make it accessible for all too.

Are you looking to improve recruitment?

Again, a higher flexible benefits allowance could make your new roles more attractive to potential candidates.

However, you’ll need to consider how a higher flexible benefits allowance offsets against salary, and whether a lower salary but higher flexible benefits allowance would lead to more applications.

Are you trying to meet demand?

Maybe you’ve introduced flexible benefits simply to meet employee demand and allow for a little more flexibility for a workforce of increasingly varying demographics?

You may have other areas of HR and employee benefits that require a larger budget, or you simply don’t have a large budget in the first place.

Simply implementing flexible benefits can go a long way and so a large flexible benefits allowance for employees isn’t always necessary, particularly for SME’s.

Factors that could affect your flexible benefits allowance

- The number of employees in your business

You may have a good size budget compared to the number of employees you have, or vice versa. Your company may have big expansion plans or is growing rapidly. You’ll need to consider your overall HR and employee benefits budget and calculate how this will be spread out across all your employees

- Your employee benefits package and the benefits included in your flexible benefits plan

Some benefits such as a Dine Card, a yearly membership for dining out discounts, require much less contribution than benefits such as the Bike to Work Scheme for example. If you’ve got a range of benefits that cost less, then a lower flexible benefits allowance would suffice. For larger ranges of benefits which require higher contributions, a bigger flexible benefits allowance would be more suitable.

- How have the demographics within your business changed in the last year?

If you’ve scaled and grown your team to include more employees of varying demographics with differing needs, you’ll need to make sure your benefits package is suitable for everyone. Your flexible benefits allowance should therefore be suitable to ensure every employee has adequate, fair access to the benefits most relevant to them.

- Your overall budget for employee benefits

You’ll need to consider your overall budget, how this was split up before and if you’ll be including the flexible benefits allowance under your HR and employee benefits yearly budget. How does it compare to previous years and how has the company scaled in terms of number of employees in comparison? Do you need to split your budget across multiple areas such as reward and recognition?

Percentage of salary or fixed amount for all employees?

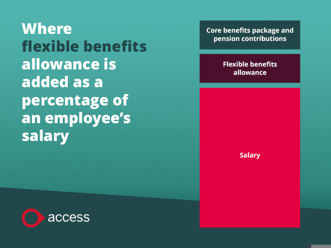

Often, a flexible benefits allowance is set as a fixed percentage of the employee’s salary. This percentage can vary from business to business. However, you might wish to set this as a fixed amount for all employees regardless of salary.

Again, this depends on how you structure your budgets and whether your flexible benefits allowance comes under your HR and employee benefits budget or if it’s simply added as a percentage of an employee’s salary.

Assess previous year’s performance

If you’ve had flexible benefits for a while and have previously set flexible benefits allowances, a good way to determine what your new flexible benefits allowance should be is to review how employees used it in previous years. However, there’s a few things to note when doing this.

Don’t be fooled by an increased uptake when setting your new allowance

Employees may use their flexible benefits allowance on a gym scheme for example, but only because they wanted to use their allowance without losing it. This doesn’t necessarily mean they utilised the employee benefit. So, while your employees may be using all their flexible benefits allowance, it doesn’t necessarily mean it was effective and that you should consider maintaining or even increasing the same flexible benefits allowance.

Feedback and surveys in this circumstance are crucial to assessing the effectiveness of your flexible benefit plan. Are your employees utilising the benefits they’re assigning their flexible benefits allowance to? If not, it could mean either your flexible benefits allowance is too high, or simply the benefits on offer aren’t applicable or effective for your employees.

That said, there could be benefits in your flexible benefits plan that require a higher flexible benefits allowance, and so in this case increasing that allowance could be the way forward.

Review your KPI’s

Another thing to consider is how your flexible benefits plan affected your HR KPI’s and targets such as recruitment, retention and employee satisfaction.

Did your flexible benefits plan help improve retention and decrease turnover? Did it help improve recruitment? Was it referenced in any employee surveys in a positive or negative light?

There are many factors that can affect the performance of your employee benefits package including communications and the effectiveness of the individual benefits on offer. However, if your flexible benefit plan proved to be ineffective or didn’t perform as well as you’d hoped in helping you achieve your objectives, it might be time to review your flexible benefits allowance.

How much have employees contributed to their benefits?

Another great way to assess the effectiveness of your flexible benefits allowance is to assess your employee’s contributions to their employee benefits.

For example, in many flexible benefit plans employees can choose to use some of their flexible benefits allowance and then cover the rest of the cost of the benefit themselves. So, if someone takes out a Dine Card at £49.99 for example, they may choose to allocate £20 from their flexible benefits allowance and cover the other £19.99 themselves.

If your employees have been contributing a lot to their employee benefits alongside using their flexible benefits allowance, boosting the flexible benefits allowance may actually be more beneficial.

If employees are happy to contribute more to the cost of their employee benefits, keeping your flexible benefits allowance the same or even reducing it might seem like the first option.

However, actually increasing the flexible benefits allowance in this case could be hugely beneficial and could be received by employees extremely well.

A simple communication along the lines of

“we saw you contributed ‘x’ to your employee benefits last year so this year we’re helping you out by increasing your flexible benefits allowance”

could be hugely effective!

Step by step guide to determining your flexible benefits allowance

- Determine your goals and objectives. What are your business objectives? HR and employee benefits objectives? What are your targets and goals when it comes to your employee benefits package? What are you ultimately trying to achieve and where does your flexible benefits plan rank in comparison in terms of importance?

- Consider all the factors that could affect your employee benefits allowance. Whether it’s the size of your company or how the demographics have changed in the last year, ensure you consider all the factors that could affect the effectiveness of your flexible benefits allowance.

- Decide whether you’ll set your allowance individually or as a percentage of salary. Many usually set theirs as a percentage of salary, but how you do it is totally up to you and your business.

- Assess previous year’s performance and adjust accordingly. Assess the effectiveness of your flexible benefits allowance from previous years and make necessary adjustments.

See our employee benefits platform in action

Latest flexible benefits resources

Our flexible benefits resources offer advice and guidance from industry experts.