90% of employers say they have a responsibility to support staff through the cost of living crisis - but how?

Stepping up during a crisis is a sure sign of a good employer – and the past few years have been a test for almost every organisation.

As many as 90% believe they have a responsibility to support their employees through the cost-of-living crisis, according to a survey by industry magazine HR Grapevine, commissioned by The Access Group. Over half (52%) have provided financial wellbeing advice (e.g. workshops and seminars), and nearly a quarter have given one-off payments.

This is because, despite their own cost pressures, forward-thinking employers recognise that engaging and empowering their workforce even, or especially, during difficult times is key to creating a positive workplace culture where everyone can thrive.

Unsurprisingly, the UK’s challenging economic climate has been taking its toll on the nation’s mental health. Over half (54%) of adults surveyed at the end of last year said their finances were making them feel anxious, depressed, and generally overwhelmed.

Our own figures reflect this too. In the past year, we’ve seen a 55.9% uplift in the number of users accessing our employee assistance programme (EAP) within our employee benefits platform, which offers support for both health and financial wellbeing.

Analysis of data within the platform reveals that by far the highest proportion of calls to the employee assistance programme (EAP) helpline – just over two-fifths – were from people struggling with their mental health. Of those receiving counselling by phone, 91% had anxiety; 42% had low mood and 31% had depression.

While all this might look like a cause for concern, the fact that people are actively taking steps to address their mental health difficulties is a positive.

HR professionals have also recognised the difference employers can make to people’s lives – and the difference happy and productive employees can make to an organisation.

Opting out

That safety net might not be around for long though. Two-fifths of those surveyed admitted they had no plans to support employees with the cost-of-living crisis in six months’ time, and just 17% said they would continue to offer financial wellbeing advice – a drop of 35%.

Yet the Resolution Foundation has warned that the cost-of-living crisis could continue until the end of next year, while real wages might not reach early-2022 levels until 2027. By offering financial advice on a permanent basis, they could ease people’s immediate concerns, and allow them to focus on their work.

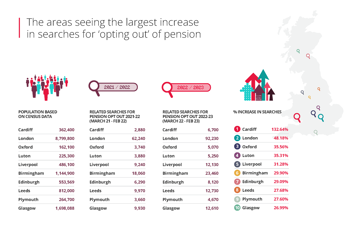

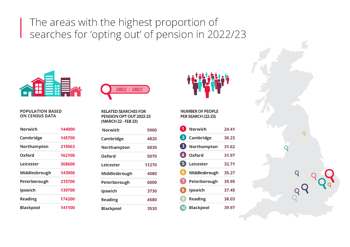

We’ve already seen signs of employees taking potentially damaging measures to make ends meet. Google searches from the past year indicate that the number of people thinking about opting out of their pension has jumped by more than 36%.

However, people in some parts of the UK are feeling the pressure more than others, with Cardiff topping the list with a staggering 133% increase in searches. Around a third of people in the Welsh capital work for the public sector which means at least some of them could be giving up on an attractive pension scheme.

Cities like London, Oxford and Edinburgh, which are regularly named among the most expensive places to live in the UK, also feature in the top 10.

While people may feel they have no choice but to pause their pension payments, it means they’re missing out on tax savings, employer contributions and earnings from investments.

Explaining more, Sam Robinson, Financial Advisor at Almond Financial, said:

"For the vast majority of people, you shouldn't opt out of your workplace pension. It's free money from your employer and it can save you tax. There are exceptions, of course; people with large incomes and that have accessed pensions before should ensure they understand how this may affect them. Before making any big decisions, get advice on the impact of not contributing.

"HR professionals should be aware that the guidance for auto-enrolment ensures employees who have opted out are automatically re-enrolled every three years. This is because it is very important to be a part of a pension scheme; it's not just the contributions you accrue, it’s the growth employees could miss out on. Staff should be encouraged to be a part of the workplace scheme.

"If you have a significant amount of funds or you are within five years of retirement I suggest seeking advice about your pension, the investment approach and your plans for retirement. A lot of schemes assume you are going to buy an annuity and therefore may switch to cash, which could be detrimental long term."

How can employers help?

Not every employer can offer above-inflation pay rises, nor one-off payments and loans. But that doesn’t mean employees can’t be supported in other ways. One option is on-demand pay, which allows them to draw down wages they’ve already accrued rather than waiting until payday.

Read how the Co-operative Bank used Access Earlypay to provide its employees with flexible and instant access to the pay they’ve already earned via our on-demand pay app.

According to data from Access EarlyPay, part of our HR and payroll software portfolio, as many as 93% of users have found it a helpful way to manage their finances during the cost of living crisis.

Around three-quarters of those who’d relied on high cost credit previously said they no longer felt the same pressure because they could draw out their earnings earlier, and the same proportion again said they’d look for employers who offered this facility in future.

Analysis of the latest Access EarlyPay data shows a significant rise in the number of people drawing their wages in the last few days before payday, which could help them prioritise essential bills and avoid late payment fees. There were 4,212 transactions made 15 days before payday – but 6,030 transactions three days before payday.

Abhishek Agrawal, director of Access EarlyPay, said:

"On-demand pay has really come into its own this year but its benefits extend beyond the current crisis. It empowers employees with the flexibility to manage their finances in a way that works for them, which as our customers have seen, can translate into more satisfied and engaged teams."

We’ve also joined forces with Experian to make it easier for employees to access financial products and services. With their permission, an employer can digitally verify employment and income with a lender to help them get the best deals.

Oliver Quayle, Head of People Products at The Access Group added:

"Organisations that prioritise all aspects of employee wellbeing – mental, physical and financial health – almost always see higher levels of engagement and productivity.

"With Millennials and Gen-Z now dominating the workplace, it’s more important than ever that employers invest in the kind of holistic, consumer-grade support they have come to expect elsewhere – especially where there are talent shortages. Whatever organisation they’re dealing with, they want the experience to be frictionless.

"Data from your HR software is key to driving effective engagement strategies. Absences or poor performance are common signs that someone is struggling and may need signposting to support such as counselling. These insights also enable HR managers to proactively launch new initiatives that promote wellbeing, from cycle to work schemes and on-demand pay, to finance and pensions advice, and measure their success."

AU & NZ

AU & NZ

SG

SG

MY

MY

US

US

IE

IE