How The Current Economy Will Impact Construction – Our Survey Results

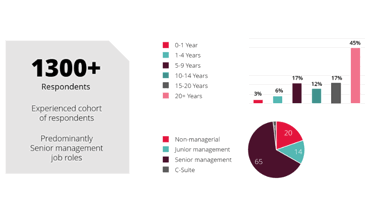

In November 2022, The Access Group surveyed over 1,300 construction professionals – from estimators to finance managers – on their key challenges, their strategies for remaining competitive and their views on technology adoption to help guide growth through the oncoming difficult economic period.

Our results tell a story of resilience and confidence, while remaining realistic about the storm ahead.

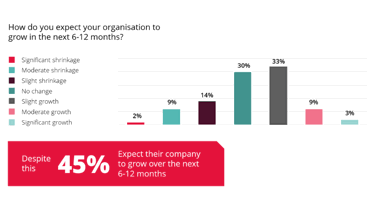

The optimism and drive of the sector is highlighted by one of our key findings – that 45% of our respondents predict their companies will see growth in the next 12 months during economic recession.

This post delves into what our survey results tell us about the coming year for construction, including key obstacles and the technology firms are planning to adopt to help protect profit margins while winning and delivering projects to a high standard.

Our Respondents

45% of our survey respondents hold over 20 years’ experience in the sector. Over 65% held senior management roles, meaning our results represent a top-down view of the industry.

Our respondents covered a huge wealth of job titles, but we had a significant representation of estimators, quantity surveyors, operations managers and finance leaders.

The Current UK Economy - Challenging Times Ahead

According to the Office of National Statistics, the UK construction sector, comprising 9% of the UK’s GDP, is well on its way to recovering from the severe hit from the COVID-19 pandemic.

The level of construction output in September 2022 was 4% (£575 million) above February 2020 levels, indicating recuperation from the unprecedented events of 2020 - 2021.

However, new work was 0.3% (£29 million) below February 2020 levels, with widespread reports from construction businesses that customers are now putting new work on hold (The Guardian, September 22).

Economic headwinds have seen a further turn at the final quarter of 2022, with inflation at a historic 40-year high, the War in Ukraine impacting on material and energy costs, and the UK facing a long and deep recession on-par with the ‘Great Recession’ of 2008.

Knock-on effects are already apparent, as new build projects from the leisure and hospitality industries have seen a decrease according to the consultancy Capital Economics (The Guardian, September 22).

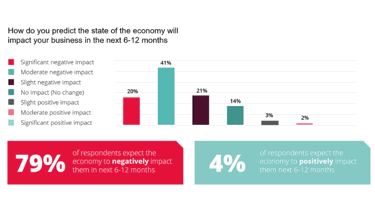

We asked our respondents ‘How do you predict the state of the economy will impact your business in the next 6-12 months?’

With the economy entering recession, it is no surprise that the majority of our respondents in the sector expect a negative impact. 79% of respondents are expecting a slight to significant impact on their business, with 5% stating the current economy will see a positive impact on their business.

During our panel discussion, Caroline Noakes MP highlighted positives from the UK government’s recent mini-budget and investment in infrastructure when considering the future of a vital sector.

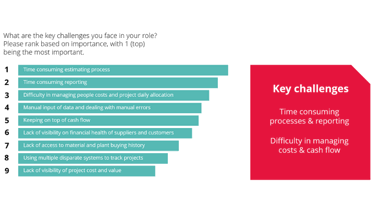

The top 3 key challenges faced in our respondent’s roles were:

- A time-consuming estimation process

- An excess of time spent on reporting

- Difficulty in managing people costs and daily allocations within projects

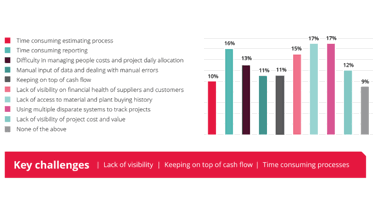

We also asked our respondents “which challenges do you expect to get worse in the next 6-12 months?”

Key challenges over the next year will be:

- A lack of visibility (of both internal projects and suppliers)

- Keeping on top of cash flow

- Time-consuming processes, including reporting and estimating project costs and demands

Other challenges included errors from manual input of data and a lack of visibility on the financial health of both suppliers and customers, which can quickly lead to toxic debt.

When the economy is squeezing businesses and profit margins are threatened, it is more important than ever to keep an eye on productivity, and a slow estimation process can disrupt the bid process which drives the construction sector.

Risk & Bad Debt

Bad debt is one of the biggest crises facing the sector. Analysis by Experian shows the monthly average insolvencies for the first four months of 2022 were 30% higher than in 2019, and the current economic outlook suggests this will continue into 2023.

Insolvencies of suppliers and subcontractors leads to bad debt piling up, which can have a domino effect across the sector and full financial visibility across the supply chain can be difficult.

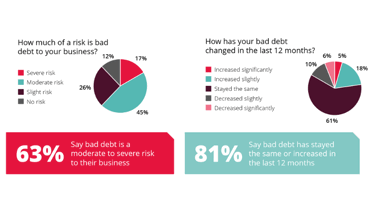

63% of our respondents believe bad debt is currently a moderate to severe risk to their business, with 81% stating that bad debt has remained the same or increased over the last 12 months.

When it comes to predicting bad debt changes over the next 6-12 months, 70% are predicting that bad debt will increase in the next 6-12 months, with a further 23% predicting it will remain at the same level. 10% expect a significant increase.

Stuart Walker, Commercial Director for Checkbank Group, outlined his top tips for construction companies to avoid bad debt piling up in a challenging landscape during our panel discussion:

- Get the basics right – if you know who owes you money and when it is due, you are already ahead of the game.

- Introduce organisational awareness that ‘cash is king’ – and secure a cashflow forecast.

- Be prepared to say goodbye to bad customers that delay payment, even if you have a good relationship.

- Invest in a good credit controller

You can read more about the risk of bad debt and how to control it in our eBook Beating Bad Debt In Construction.

Construction Is Key To Leading Recovery

As proven from the post-COVID-19 revival, where output saw a devastating 46% collapse during lockdowns (Statista), the sector will be key to leading growth and recovery in the UK, driving projects such as the government’s targets for new housing and ‘Levelling Up’ plans to kickstart regeneration in derelict areas of the country.

"Despite the negative outlook for the economy over the next year, 45% of those surveyed predicted their companies will grow during recession, with only 2% predicting a significant shrinkage."

Recent research into supply chain woes hitting the manufacturing sector through Unleashed Software’s Manufacturers Health Check found that the building and construction sector were the only sector in the UK not suffering from significant increases in product stockpiles.

The plastics and rubber sector saw a 180% increase in the average value of stock in hand from Q3 2019 to Q3 2022, whereas building and construction manufacturers saw a 41.56% decrease in value over the same period, the only sector to do so.

This indicates the sector isn’t being hit with the same supply chain and lead time issues as others, with demand increasing rather than decreasing. A recent Guardian report into the construction industry also highlighted reasons to remain confident, with Max Jones, a director at Lloyds Bank’s infrastructure and construction team, highlighting that

Recent financial results from tier one firms showed healthy balance sheets and strong pipelines of new work. Others priced in jobs at a high point and are buying materials now as prices cool.

The results of our survey add to this confident outlook within the sector.

We also asked respondents to rank in terms of importance issues which are key to keeping their organisations competitive in the next 6-12 months.

Leading in importance are:

- Managing the supply chain and costs

- Tackling construction project costs end-to-end

- Efficient and transparent project estimating, quoting and valuations

Carol Massey, Head of Construction at The Access Group, highlighted the importance of how technology both helps increase visibility of the supply chain and the health of your own business during our panel discussion.

How Technology Continues To Transform The Construction Sector

We also posed questions about the adoption of business technology in construction, a sector that often relies on Excel and outdated software to manage its supply chain, costs and workforce.

The construction industry can be slow to technology adoption to make processes as efficient as possible, with many businesses still relying on spreadsheets to put together complicated bills of estimations.

We asked our respondents which types of software they are currently utilising within their businesses:

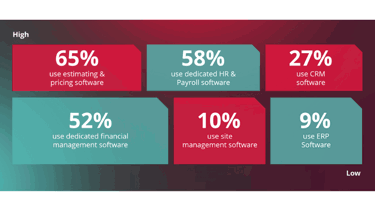

65% of respondents use estimating and pricing software and 58% use dedicated HR and Payroll software, whereas only 10% use site management software and 9% use ERP software.

52% use dedicated financial management software to keep track of costs and revenue.

The top 3 software solutions construction companies are looking for in the next 6-12 months are:

With a time-consuming estimating process ranking as one of the leading challenges in our survey, it is clear that construction firms are looking for ways to reduce their time spent on estimating work in order to create more bids and win more work.

Training software is part of the solution for the recruitment and skills shortages within the sector, where a high turnover means recruits need to be trained up efficiently. E-Learning also helps increase essential education covering health and safety within the sector.

Finally, ERP software is extremely useful to help increase visibility of the full supply chain from procurement to asset and site management. This overview gives real-time updates and collects and presents data in a way which is easy to analyse. This helps managers view projects end-to-end and easily identify issues within a project.

We also asked respondents to rank features, in order of importance, of software to help businesses to remain competitive when considering buying software.

The top three features were:

- Ease of Use

- Security

- Integration with Existing Products

It is not surprising that construction is demanding software which is intuitive and simple to use while still protecting sensitive project data within software systems.

How Construction Is Preparing For 2023

Our Survey gives a view of an industry cautious about the year ahead, with firms aware of unfavourable economic headwinds and keen to tackle issues to encourage growth.

With recovery from COVID-19 well on the way and impacts from recession incoming, our overview of the industry reveals high levels of confidence with 45% of those surveyed predicting their firms will grow over the next 12 months.

Blockers such as low project visibility, bad debt and slow estimation and reporting processes are being confronted through investments in technology, from estimation software through to end-to-end ERP systems.

The Access Group’s Construction Suite has been developed to cover specific demands and obstacles within the sector – our estimation and site management software helps speed up processes, automate reporting and increase accuracy – helping you win more bids and protect your profits during a difficult economic climate