Construction accounting software is specifically designed to meet the unique needs of the construction industry, while general accounting software is a more broad-based tool that can be used by businesses in various sectors.

Some of the key differences include:

- Project-based accounting:

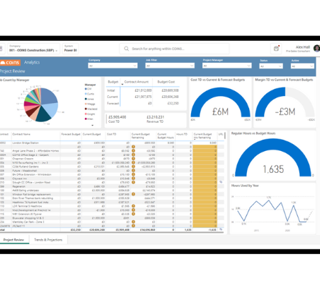

Construction accounting software is built around managing individual projects, tracking costs, revenue, and profitability for each job.

General accounting software typically focuses on overall financial performance and may not have the same level of granularity for tracking project-specific data.

Construction accounting software includes features for detailed job costing, allowing businesses to track labour, materials, equipment, and other costs associated with each project.

General accounting software may not have the same level of detail for tracking job costs.

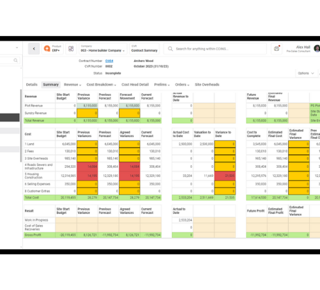

Construction accounting software can support CVR (Cost Value Reconciliation) tracking and reporting, which is commonly used in the construction industry.

General accounting software may not have this specific feature.

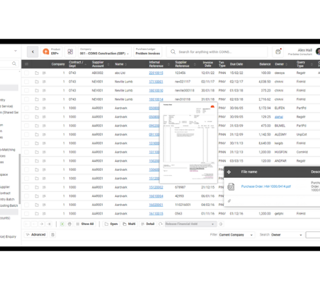

Construction accounting software includes tools for generating progress invoices and tracking payments received.

General accounting software may not have the same level of functionality for progress billing.

- Compliance with industry regulations:

Construction accounting software often includes features for complying with specific industry regulations, such as certified payroll reporting.

General accounting software may not have these specific features.

- Integration with construction-specific tools:

Construction accounting software may integrate with other construction-specific tools, such as project management software, estimating software, and field service management software.

General accounting software may not have the same level of integration with construction-specific tools.