By analysing data from 2,000 businesses, the report demonstrates the tangible financial benefits of this approach. Notably, companies with over 1,000 employees are realising average annual savings of nearly half a million pounds (£463,629) through Holiday Trading. One organisation with 2,000 employees even achieved savings exceeding £1.2 million in salary and NICs.

What is the National Insurance rise?

The UK’s Autumn Budget 2024 was announced by Chancellor Rachel Reeves in October. One of the most significant parts of the budget was the rise in National Insurance Contributions (NIC). The changes announced around NICs were:

- The employer NI rate is rising from 13.8% to 15%

- The threshold on employee earnings at which NI applies drops from £9,100 to £5,000

The reaction from businesses has been varied, however, CIPD research published on 17th February reveals the intentions of employers more clearly. For example, in this survey of more than 2,000 UK employers, 25% plan to make redundancies in the three months leading up to March 2025 suggesting that employers are struggling to see how they can offset the rise in National Insurance contributions without impacting their employees.

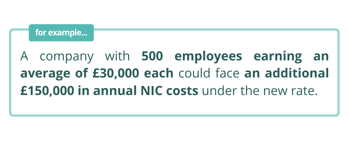

How much could the rise in National Insurance cost employers?

While the precise financial impact of the National Insurance rise varies based on business size, the burden is relative, and undeniable. For medium to large enterprises, the sheer volume of contributions and staff amplifies the financial strain, whilst for small businesses, any cost increases can have a substantial impact.

For example, a company with 500 employees, each earning an average of £30,000, could face an additional £150,000 in annual NIC costs.

Furthermore, the recent budget also announced increases in the minimum wage. Those over 21 will see a 10% rise, while those under 21 will experience a 20% increase, further impacting wage budgets.

Faced with these escalating costs, UK employers are adopting diverse strategies. While a proactive 34% are leveraging salary sacrifice schemes (CIPD), 32% are considering headcount reductions, and a quarter plan to scale back expansion and growth. These stark figures underscore the urgent need for strategic cost-management solutions.

How businesses could use salary sacrifice to offset employer NI contributions

The Access People report highlights the growing adoption of salary sacrifice schemes as a powerful tool for mitigating the rise in national insurance costs, whilst also providing valuable cost savings for employees.

Through real-world case studies and user data, the report demonstrates how organisations are effectively leveraging their employee benefits strategies, particularly when it comes to salary sacrifice, to achieve substantial savings without compromising their ability to attract, retain and engage their employees.

Does salary sacrifice reduce employer NI contributions?

Salary sacrifice schemes offer a flexible and effective means of reducing NIC liabilities. By allowing employees to exchange a portion of their gross salary for non-cash benefits, such as enhanced pension contributions, Cycle to Work programs, and Holiday Trading, employers can lower their overall NIC contributions.

Take a look at the article ‘What is Salary Sacrifice’ for a deeper understanding of the types of schemes and strategies.

Holiday Trading salary sacrifice schemes – Highest engagement and savings

Holiday Trading schemes allows employees to buy and sell annual leave from and to their employer. When employees purchase additional annual leave through the scheme, the employer not only saves on NICs, they also save on the salary sacrificed too.

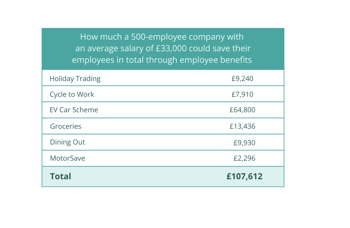

Among the various salary sacrifice options, Holiday Trading emerged as a particularly popular and effective strategy, presenting the largest opportunity for savings. The Access People report reveals that Holiday Trading boasts the highest engagement rate, averaging 20% across all sectors, compared to 7% for Cycle to Work and 4% for Electric Vehicle (EV) schemes.

This high engagement directly translates to substantial NIC and salary savings, which equated to more than £40m for Access customers.

- Average Savings: Employers implementing Holiday Trading schemes realised average savings of £132,432.03 in 2024.

- Large Enterprise Impact: Organisations with over 1,000 employees achieved average savings of £463,629.04 through Holiday Trading in 2024.

- Sector-Specific Success: Engineering, manufacturing, and financial services sectors demonstrated particularly high engagement, exceeding 25%. One organisation in infrastructure services with 2,000+ employees achieved a remarkable 46% participation rate in 2024, resulting in savings exceeding £1.3 million in salary and NICs. This case study underscores the significant financial benefits that can be realised through strategically implemented Holiday Trading schemes.

- Employee Engagement: Providing employees with greater control over their work-life balance also helps support talent attraction and retention strategies and ultimately happier and more productive employees.

EV Car salary sacrifice schemes: A high-value proposition

Electric Vehicle (EV) car schemes represent another significant opportunity for employers to reduce their NIC liabilities.

- Substantial Average Savings: The high average order value associated with EV leasing results in substantial average NIC savings of £56,000 per participating business.

The decision in the Autumn budget to freeze benefits-in-kind rates until 2028 further enhances the attractiveness of EV car schemes as a strategic salary sacrifice option.

Does salary sacrifice cost employers?

The significant cost for businesses implementing salary sacrifice schemes will be with how the schemes are administered. However, the report’s findings make it clear that the long-term financial advantages for businesses is significantly outweighing administrative expenses.

Leveraging Technology

The perceived cost of salary sacrifice primarily stems from the administrative requirements involved. However, with salary sacrifice schemes being part of a wider employee benefits package that is integrated as part of a modern HR suite, employers can monitor and manage engagement with the schemes they participate in. Implementing desired schemes typically involves updating employee contracts and adjusting payroll systems. Fortunately, these tasks can be efficiently managed within a comprehensive HR platform, streamlining the process and reducing the burden on HR and payroll teams.

Calculating NI Savings

Accurately calculating costs vs savings will be particularly important for organisations looking to their salary sacrifice to provide NI savings. Access People is providing organisations with personalised breakdowns and projections to help demonstrate ROI from their employee benefits strategies.

Enhancing Employee Engagement

Salary sacrifice schemes go beyond the bottom line, contributing to a more engaged and satisfied workforce. By offering attractive benefits, employers can enhance their employer brand and attract and retain top talent.

Empowering employees: The multi-faceted benefits of salary sacrifice

While employers reap substantial financial advantages from salary sacrifice schemes, the benefits for employees are equally compelling. These programmes offer a unique opportunity to enhance financial wellbeing, improve work-life balance, and access valuable benefits.

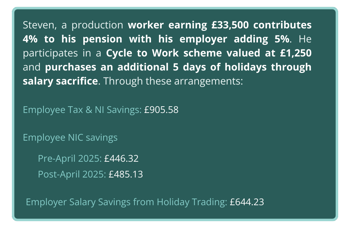

Financial Empowerment: Maximising Take-Home Pay

- Tax and National Insurance Savings: By reducing gross salary, salary sacrifice schemes directly lower the amount of income tax and National Insurance contributions (NICs) deducted from an employee's pay. This results in a tangible increase in net pay, allowing employees to retain more of their hard-earned income.

- Increased Net Pay: Receiving benefits pre-tax, rather than from after-tax earnings, effectively boosts an employee's take-home pay. This maximises the value of each benefit and contributes to overall financial wellbeing.

Beyond Financial Gains: Enhancing Wellbeing and Lifestyle

- Health and Wellbeing: Schemes like Holiday Trading play a crucial role in promoting employee wellbeing. By providing opportunities for extended time off, these programmes help foster a healthier work-life balance.

- Access to Non-Cash Benefits: Salary sacrifice opens doors to a range of valuable non-cash benefits, including enhanced pension contributions, childcare vouchers, Cycle to Work schemes, and Electric Vehicle (EV) leasing. These benefits provide access to resources and services that enhance an employee's overall quality of life.

The Power of Engagement: Driving Mutual Benefit

Employee engagement is paramount to the success of salary sacrifice schemes. When employees understand and appreciate the mutual benefits, participation rates soar, maximising the positive impact for both individuals and the organisation.

- Demonstrated Engagement: The Access People report highlights the significant engagement achieved through various schemes. Holiday Trading, for instance, boasts an average engagement rate of 20%, demonstrating its popularity and effectiveness. This high engagement is also seen in other schemes, showing the employee appetite for these savings.

- Fostering Trust and Well-being: High engagement rates not only demonstrate the schemes’ value, but also foster trust and promote a culture of well-being within the workplace.

By participating in salary sacrifice schemes, employees can reduce commuting costs, improve their work-life balance, and contribute to a more sustainable environment, all while enhancing their financial security.

Salary sacrifice as part of your employee benefits software

Optimising Employee Benefits: The Strategic Advantage of Integrated Software

The effectiveness of salary sacrifice schemes, and indeed any employee benefits programme, hinges on engagement and strategic implementation. As demonstrated by the Access People report, results vary significantly based on employer size and industry. Furthermore, factors like minimum wage proportions and workforce management complexities must be carefully considered.

Beyond Salary Sacrifice: A Holistic Benefits Strategy

Salary sacrifice forms a crucial part of a broader employee benefits strategy. Successful businesses recognise the importance of demonstrating a commitment to employee wellbeing. This extends to financial wellness, particularly critical in the current economic climate, with offerings like income protection, financial education, and tools to support budgeting.

Furthermore, a well-rounded benefits package includes lifestyle benefits and discounts on shopping, travel, and gifts, providing tangible value at minimal cost. Health and wellbeing initiatives, such as health cash plans, gym schemes, and eyecare, contribute to a healthier workforce. Commuting assistance through season ticket loans or lift-sharing programs further alleviates financial burdens.

The Power of Consolidation: Streamlining Management and Maximising Impact

Managing these diverse benefits through a unified platform helps with the administration burden. Centralising benefits like Cycle-to-Work, EV car schemes, Holiday Trading, retail discounts, wellness resources, and more on a single platform increases efficiency and engagement.

Engagement serves as the cornerstone of a successful benefits strategy. By offering a diverse range of benefits, from popular perks like retail discounts and gym memberships to strategic offerings like Holiday Trading and EV schemes, businesses can drive platform traffic and maximise participation. This holistic approach ensures that employees discover and utilise benefits that offset the National Insurance rise, resulting in mutual savings.

Data-Driven Optimisation: Refining Your Benefits Strategy

A unified Employee Benefits platform provides invaluable data insights into engagement and uptake. This data empowers businesses to refine their offerings, ensuring they align with employee needs and preferences. By tailoring the benefits package to match employee demands, organisations can achieve optimal savings and enhance overall satisfaction.

Unlock Your NI Savings Potential: Download the Report

To delve deeper into the research and discover how to maximise your savings through strategic employee benefits, download the "Navigating Rising Costs: How Employee Benefits Can Help Offset NI and Wage Increases" report.