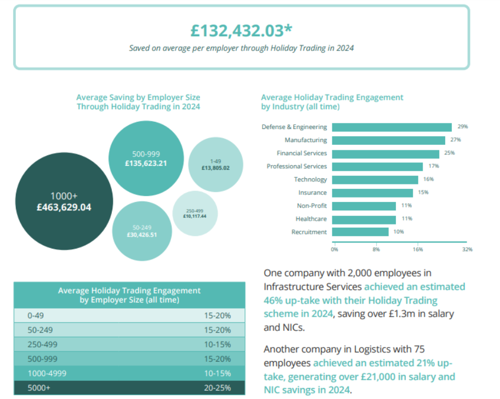

The report ‘How Employee Benefits Can Help Offset NI and Wage Increases’ by Access People, analysed data from 2,000 businesses and found that companies with over 1,000 employees are saving an average of nearly half a million pounds (£463,629) a year through Holiday Trading. One organisation with 2,000 employees even saved over £1.2 million in salary and NICs.

UK businesses face a significant challenge balancing wage budgets with the upcoming NIC increase, which will add nearly £900 per year to the cost of employing someone on the average UK salary. This has driven HR, payroll, and finance leaders to seek cost-effective solutions that don't compromise employee satisfaction.

The report reveals that Holiday Trading, which allows employees to buy and sell annual leave, boasts the highest engagement (20%) among salary sacrifice schemes and delivers the greatest savings.

Beyond Holiday Trading, the report reveals further insights into savings by employer size and industry for other popular and effective salary sacrifice schemes, including Cycle to Work and Electric Vehicle (EV) leasing. The research includes real-world examples of how companies are already strategically leveraging employee benefits like salary sacrifice schemes to offset their NIC liabilities and mitigating the coming rise.

Catherine Bennett, General Manager for Employee Benefits at The Access Group commented on the research:

“I’ve worked with businesses of all shapes and sizes since founding employee benefits provider Caboodle (now part of The Access Group), and salary sacrifice schemes have always been a crucial part of an employee benefits strategy.

"Right now, they’re more important than ever. We've seen increased uptake as organisations look to tax-efficient solutions when assessing their benefits offering. These schemes have real potential to help businesses manage rising costs, reduce the impact on employees, and ultimately improve employee wellbeing.

“A well-planned benefits strategy, including salary sacrifice arrangements, is crucial however not just for managing costs, but in attracting and retaining talent, and improving overall business performance. A proactive and strategic approach to employee benefits will be essential for all businesses looking to navigate the changing economic landscape.”

Methodology

Access People looked at data from 2000 employee benefits software customers across all business sizes and sectors. The report also breaks down some pertinent data into savings by employee size and sector.

Data correct as of November 2024.

AU & NZ

AU & NZ

SG

SG

MY

MY

US

US

IE

IE