Single Touch Payroll (STP)

Solutions: Access Definitiv, Access MicrOpay & Access WageEasy.

Access has successfully completed the Australian Taxation Office (ATO) STP Certification process for our payroll solutions. Learn how our payroll software solutions adhere to the latest STP Phase 2 regulations.

What is Single Touch Payroll (STP)?

Streamlined and automated business reporting.

STP Reporting is designed to streamline business reporting obligations, enabling employers to report payments such as salaries and wages, pay-as-you-go (PAYG) withholding and superannuation information directly from your Access payroll solution at the same time you pay employees. This means the ATO will have real-time access to Australian payroll data linking PAYG to Business Activity Statements (BAS) and Superannuation Ordinary Times Earnings Calculations.

Simplified reporting and time savings

STP Reporting changes the way you report to the ATO, but there are some key benefits that make it worthwhile.

- Streamlined and automated reporting for pay-as-you-go (PAYG) withholding. You’ll be able to remit PAYG with each payroll event.

- Reduce your admin by prefilling of W1 and W2 on the Business Activity Statement (BAS).

- End of year will become smoother as you’ll no longer have to process payment summaries, part-year payment summaries or submit end of year reporting to the ATO.

What is Single Touch Payroll (STP) Phase 2?

STP was introduced to support real-time electronic interactions between employers and the ATO. STP Phase 2 sees other government agencies begin to leverage the STP infrastructure and processes as a method of receiving payroll data.

In this instance Services Australia, will utilise STP to pass additional and more granular information to support the variety of services they deliver.

Click here to review the employer reporting guidelines.

Explore STP 2 resources by solution

Market leading cloud payroll software

From 1-10,000 employees, multi entity, pay conditions and frequencies. The Access Group has a diverse range of payroll solutions designed to streamline your processes, engage your workforce and deliver greater visibility to your teams.

WageEasy

Proven payroll for hospitality and retail businesses.

Australia’s leading payroll for smaller diverse businesses with demanding employee award conditions looking to make payroll processing simple, efficient, and flexible.

MicrOpay

Payroll choice for all industry and business structures.

Australia's most trusted payroll partner for small to medium businesses. With over 35 years’ experience, MicrOpay is the number one choice for Payroll professionals*.

*As voted in 2019 Australian Association Benchmarking Report.

Definitiv

Payroll and workforce management in one solution.

A true cloud and mobile-based software designed to bring together your rostering, time and attendance, award interpretation and payroll into the one simple solution.

People Pay

Payroll designed for NDIS built on Salesforce.

Australia’s full featured native cloud payroll built on the Salesforce platform to cater for complex pay conditions from salaried, casual, awards, EBA’s as well as external contractors.

Our solutions beyond Single Touch Payroll

- Payroll Software

- Workforce Management Software

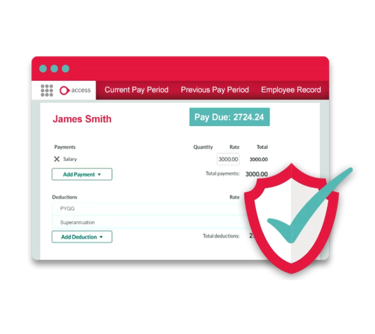

- Payroll Security

- Award Interpretation Software

- Employee Self Service Software

- Payroll Compliance Software

- Flexible Payroll Solutions

- Online Timesheet Software

- Rostering Software

- Employee Onboarding Software

- Payroll Outsourcing

- Payroll Software Training

- HR Payroll Consultant

Single Touch Payroll FAQs

How does Single Touch Payroll work?

Single Touch Payroll (STP) works by the employer using a payroll solution with STP reporting capability. The STP processing sends Year-to-Date amounts (YTD) to the ATO each time an employer reports a pay run. When the report is sent to the ATO, it is timestamped, and the ATO uses the timestamp to determine the most recent report. Report status, when sent, is waiting for ATO response. As soon as the ATO responds, the status changes to accepted rejected or accepted with errors. Reports cannot be deleted from the Payroll Reporting Centre or the ATO Business Portal for security and audit reasons. The software will list every pay event and update the event, including deleted pays.

Are Access Payroll solutions STP compliant?

With STP reporting, employers can update their payroll solution with payments such as salaries and wages, PAYG withholding and superannuation information while paying employees. Essentially, the ATO can now access Australian payroll data in real-time, connecting PAYG, Business Activity Statements (BAS), and Superannuation Ordinary Times Earnings Calculation in real-time. The Access Group has completed the Australian Taxation Office (ATO) STP Certification process for all payroll solutions. Learn how our payroll software solutions adhere to the latest STP Phase 2 regulations.

What does STP mean for employees?

The STP reporting system allows employees to access their tax and super information online through the ATO (accessible via myGov). Tax and Super information are updated each time an employee is paid. The ATO online services account shows year-to-date tax and super payments made by the employer since the start of the financial year. The information is updated each time the employer pays an employee. Employees can access their income statement (previously known as payment summary) and super payment details.

Is Single Touch Payroll compulsory?

Single Touch Payroll is compulsory for all businesses regardless of how many employees they have. July 2019 marked the introduction of Single Touch Payroll reporting. Companies report their employees' payroll and super information to the ATO each time they pay them.

What is Single Touch Payroll reporting?

Single Touch Payroll (STP) is how businesses report employees' tax and super information to the ATO. STP Reporting simplifies business reporting by allowing employers to report salary and wage payments, PAYG withholding, and superannuation directly from their Access payroll solution. The reporting delivers real-time payroll data to the ATO, which links PAYG to Business Activity Statements (BAS) and Superannuation Ordinary Times Earnings Calculations.