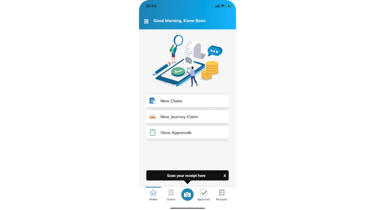

Travel Expense Management

Employees can claim corporate travel expenses when they’re out and about – whether from the train, in the airport lounge or on the road.

Scan receipts easily and there’s no need to track mileage manually. While approvers can sign off accurate claims with confidence and knowing that the right rate will be applied.

Travel and expense management software

Scan receipts easily and there’s no need to track mileage manually. While approvers can sign off accurate claims with confidence and knowing that the right rate will be applied even if the distance exceeds the ATO mileage threshold.

Staying compliant with ATO requirements is made easy with inbuilt tax tools for company cars and business travel expenses.

Quickly log accurate mileage

Employees can input their journey, and the distance is calculated for them, so it’s 100% accurate and saves time.

- Set a default home address and choose a destination by postcode, street address, offices, landmarks and more, choose one-way or return journey.

- Mileage is automatically calculated using Google Maps and allows manual mileage logging in case of diversions.

- Inbuilt verification tool - postcode finder, uses technology to increase accuracy.

- Inaccurate claims are instantly disallowed.

Reimburse business mileage at the right rate

Approvers and finance teams can rely on inbuilt verification and rate features to calculate the amount due using the correct rate.

- Approved rates are inbuilt or set custom mileage rates.

- Users are automatically dropped into the lower bracket when they go over the threshold.

- Expenses can be claimed on-the-go via the app, or by using the browser version.

Manage company vehicles and private usage

Stay on track with reporting, tax treatments and payment liability related to company cars. Easily fulfil your duty of care and ensure anyone using their car for work purposes is safe and compliant, by storing necessary documents and receiving automated alerts when they need renewing.

- Mileage and fuel claims on company cars can be tracked for reporting and tax purposes.

- Store documents such as vehicle tax, insurance, and licence details of privately-owned vehicles used for work.

- Licences due to expire are automatically flagged.

- Monitor vehicles through different stages of approval, i.e. approval from the manager and the finance team.

- Claim validation.

Watch how our travel and expense management software works

Our solutions beyond Travel and Expense Management software

Explore the various features and benefits of the Access Financial Management ecosystem.