The Complete Guide to Construction Cash Flow Management

Construction cash flow management determines a company's survival. Australian construction operations need money to buy materials, pay workers, and finish projects. Mismanaged cash flow leads to delayed projects, strained relationships, and lost opportunities. Understanding and controlling money movement allows construction firms to grow steadily.

The following guide presents practical methods for mastering construction cash flow, from basic concepts to specific challenges and step-by-step improvements for construction businesses.

Contents

- What is Cash Flow in Construction?

- Why is Cash Flow Important in the Construction Industry?

- Managing Cash Flow in Construction - Key Takeaways

- The Construction Cash Flow Cycle

- Construction Cash Flow Problems

- How to Calculate Your Construction Cash Flow Projection

- How to Improve Your Construction Cash Flow

What is Cash Flow in Construction?

Cash flow is the term used to describe the movement of money through a construction business. It is the total of incoming payments against outgoing expenses during set periods.

The flow captures everything: project payments, client deposits, and retentions come in, while materials, labour, equipment, permits, and overhead costs go out. Project success relies on monitoring these financial movements across all construction phases.

A company's financial health fluctuates between positive and negative cash flow periods. Progress payments, retainer fees, and equipment rental income create positive flow when they exceed expenses. Material purchases, subcontractor payments, and equipment maintenance without matching income lead to negative flow.

Construction projects naturally swing between these states, demanding careful money oversight for long-term stability.

Why is Cash Flow Important in the Construction Industry?

Building projects face unique financial challenges due to upfront costs and delayed payments. These challenges help explain why cash flow management is so important in construction.

- Upfront Costs - It's expensive to start a construction project. Millions of dollars’ worth of materials sit in warehouses, workers expect weekly wages, and equipment costs pile up daily.

- Operational Stability - Cash flow lets companies pay workers on time, maintain vendor relationships, and keep equipment running smoothly. With smart forecasting, firms can plan material deliveries, optimise crew sizes, and schedule maintenance.

- Vendor Relations and Purchasing Power - Strong cash positions allow companies to negotiate better prices with suppliers, get better payment terms, and maintain reliable access to materials.

- Project Continuity - Poor cash flow can cause a cascade of problems. When vendors require payment before delivery, workers may abandon sites, and equipment failures increase when maintenance is postponed.

- Business Growth - Limited cash reserves force companies to pass up promising projects while competitors score transformative contracts. Late payments can lead to material shortages, project delays, and contract penalties.

- Financial Stability - Late payments can bankrupt companies. Companies with steady cash flow can weather unexpected challenges, take advantage of supplier discounts, and finish projects on time.

Managing Cash Flow in Construction - Key Takeaways

Construction cash flow management directly affects every part of construction operations, from worker satisfaction to project completion rates. Here are the most impactful construction practices:

- It takes weeks or months for construction companies to get paid. Cash flow management keeps projects on track.

- Regular monitoring of money movement reveals problems early - catching issues like underbilling, slow client payments, or rising material costs before they snowball into major financial challenges.

- Financial stability comes from smart forecasting and strong vendor relationships. You'll get better prices and terms with a good understanding of your cash needs.

- Automated systems and clear payment terms prevent common cash flow problems - using software to track expenses, send invoices promptly, and enforce payment schedules keeps money flowing steadily through the business.

Total Construction Cash Flow Control with Access Coins

Access Coins is an ERP platform built for construction that provides a single source of truth for all of your financial data.

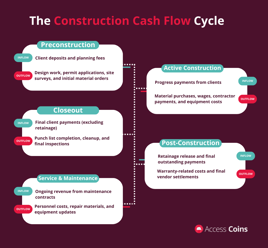

The Construction Cash Flow Cycle

Structural projects follow a predictable financial pattern. How to manage cash flow in construction is vital as each phase—from initial planning through to maintenance—demands different spending levels and generates varying income. Knowledge of these patterns allows for spending plans, payment schedules, and operational stability throughout the project lifecycle.

Preconstruction

There's a steady flow of money during preconstruction. Design work, permit applications, site surveys, and initial material orders pile up. Client deposits and planning fees are the only sources of income. Companies must maintain enough reserves for upcoming phases to prepare for these early expenses.

Active Construction

Active construction may spike project spending. Material deliveries, worker wages, equipment costs, and subcontractor payments create constant financial demands. Income starts flowing through progress payments, but timing gaps between expenses and payments strain cash reserves. Companies often juggle multiple payment schedules while maintaining steady work progress.

Closeout

Financial pressure eases during closeout as major expenses decrease. Final payments arrive from clients, but retainage holds still tie up significant money. Companies face several essential expenses: punch list items, cleanup costs, and final inspections. Careful documentation speeds up final payment collection.

Post-Construction

Money movement slows considerably after construction ends. Companies focus on collecting final payments, including retainage releases. Expenses drop sharply, though some costs continue through warranty periods. Financial attention shifts toward settling remaining vendor bills and closing project accounts.

Service and Maintenance

Cash flows are regular but smaller in the service phase. Maintenance contracts bring steady income while requiring minimal materials and labour. Companies take care of routine maintenance, repairs, and updating equipment. Maintaining profitable long-term relationships with clients is key.

Construction Cash Flow Problems

There are unique financial challenges at every stage of a building or development project. It doesn't take long for a little problem to snowball into something big that threatens the completion of a project and the stability of a business.

Common construction cash flow problems include:

- Delayed invoicing

- Slow payments

- Change orders

- Rework

- Poor forecasting

- High overheads

- Underbilling

- Increased costs

- Early bill payments

- Incorrect inventory management

Delayed Invoicing and Slow Payments

Late invoices could lead to late payments. Waiting too long to bill clients or process payments creates cash flow gaps. It's even worse when clients don't pay on time, extending payment cycles to 60 or 90 days. The delays force contractors to dig into their cash reserves or take out expensive short-term loans.

Change Orders and Rework

Unexpected changes and corrections drain cash reserves quickly. Before clients approve additional payments, change orders require immediate material purchases and labour allocation. Rework scenarios double the financial strain: Contractors pay twice for labour and materials while project timelines extend. Payment for these extras often lags weeks or months behind the actual work.

Poor and Inaccurate Forecasting

Missed financial predictions leave organisations scrambling. Inaccurate forecasts mean insufficient cash for payroll, material purchases, or equipment needs. Financial teams risk project delays and strained vendor relationships when they fail to anticipate spending patterns or payment timing. Wrong predictions about material costs or labour needs quickly multiply across multiple projects.

High Overheads

Fixed costs eat into cash reserves month after month. Office space, permanent staff, equipment payments, and insurance premiums demand regular payment regardless of project income. The steady expenses force industry players to keep higher cash reserves, which limits growth opportunities and project execution.

Underbilling

Billing errors cost you money. When field teams miss work items or underestimate completion rates, earned money goes uncollected. Unpaid charges add up, leaving a gap between income and expenses.

Increased Material, Equipment, and labour Costs

Project managers have to spend more than planned when materials, equipment, or labour costs spike. Businesses have to absorb these extra costs if there are no escalation clauses in their contracts.

Paying Bills Early

Premature payments waste cash flow opportunities. When accounts payable departments pay vendors before payment terms are required, they give up cash needed elsewhere in operations. While early payment discounts seem attractive, they can drain the working capital needed for payroll or critical purchases.

Poor Inventory Management

Excess materials lock up valuable cash. Overordering ties up money in unused inventory while storage costs accumulate. Poor tracking leads to emergency purchases at premium prices. Theft and damage create extra expenses. Smart inventory oversight keeps cash flowing instead of sitting idle in stockpiles.

How to Calculate Your Construction Cash Flow Projection

Accurate cash flow projections prevent financial surprises and enable smarter business decisions. The following steps show money movement throughout the project phases.

Step One: Calculate Cash Inflows

Money may enter through multiple channels during construction projects. Expected inflows include client progress payments, release of retainage, equipment rental fees, and material resale. Managing cash flow in construction requires scheduling these amounts month-by-month, noting exact payment dates from contracts—Mark milestone payments, deposit schedules, and any seasonal income variations that affect cash availability.

Construction cash inflows typically come from three main sources:

- Project-based income includes progress payments, such as 25% at foundation completion

- Milestone payments, such as $100,000 upon steel structure completion

- 5-10% retainage release after project completion

Operational income comes from equipment rentals to other contractors, excess material sales, and salvage revenue. Additional revenue might include insurance settlements, tax rebates, and interest earned on business accounts.

Step Two: Forecast Cash Outflows

Money leaves steadily throughout construction projects. List all expected expenses: material purchases, labour costs, subcontractor payments, equipment rentals, permit fees, and overhead expenses. Mark large purchases early to prepare cash reserves. Include regular expenses such as payroll, insurance premiums, and office costs. Note payment deadlines for suppliers and rental companies.

Step Three: Calculate your Net Cash Flow

Subtract total outflows from total inflows each month to find net cash flow. A positive number means more money came in than went out. A negative number signals potential cash shortages requiring attention. Use the simple formula:

Net Cash Flow = Total Cash Inflows - Total Cash Outflows

Calculate this figure for each upcoming month to spot potential problems early.

Step Four: Report on your Cash Flow Projections

Regular reporting keeps everyone in the loop. Weekly or monthly reports show actual versus projected cash positions, highlight significant variances, explain their causes, and show upcoming big expenses or income.

Stakeholders need to know about cash reserves, upcoming shortfalls, and plans for fixing them. These reports are great planning tools because they are simple and consistent.

How to Improve Your Construction Cash Flow

Smart policies and modern tools such as construction ERP offer practical solutions to strengthen financial control and improve cash flow. Implementing these improvements requires commitment, but the results transform business operations and project delivery capabilities.

Include Payment Terms in your Construction Contracts

Clear payment terms prevent costly misunderstandings. Contracts should specify payment schedules, milestones, and penalties for late payments. They should also include deposit amounts, progress payments, and retainage release conditions.

A well-structured contract includes specific due dates for all payments, defines acceptable payment methods, and establishes consequences for missed deadlines. Progressive payment schedules match income to project expenses, while retainage terms ensure prompt completion.

Sharp change order provisions prevent scope creep from disrupting cash flow patterns. Thorough contracts protect both parties while maintaining steady money movement.

Automate your Billing and Invoicing

Automated systems revolutionise payment collection and financial tracking. A 2023 KPMG Global Construction Survey reveals growing technology adoption in construction. 46% of engineering and construction firms now use integrated project management systems across all projects, while 37% are gradually implementing them. Only 17% haven't started using these systems.

Construction accounting software generates invoices, tracks pending payments, and reminds clients about upcoming or overdue payments.

Regular and consistent billing cycles maintain steady income streams throughout project phases. Digital systems eliminate manual delays in creating and sending invoices, reducing the gap between work completion and payment collection.

Automation catches billing errors before they reach clients, maintaining professional relationships. Scheduled reminders keep payments moving without staff intervention, freeing teams to focus on project execution rather than payment collection.

Reduce Over and Underbilling

Construction management software prevents costly billing mistakes and maintains accurate payment collection. Digital tools track actual work progress against scheduled values, catching disparities before they affect cash flow.

Project managers monitor real-time completion percentages, ensuring payment applications match work status. Automated systems flag unusual patterns or missing items, preventing revenue leakage through forgotten change orders or missed work items.

Keep income and expenses in line with regular field progress reconciliations. Billing accurately builds client trust and protects profit margins. Early warnings about billing issues allow quick fixes before they get out of hand.

Ensure Visibility and Transparency of Your Cash Flow

Real-time financial tracking transforms decision-making across project teams. Construction financial management software provides instant views of cash positions, upcoming expenses, and payment status across multiple projects. Field supervisors access current financial data when planning purchases or scheduling work phases.

Cash availability allows project managers to avoid costly work stoppages and optimise schedules. Transparent financial reporting also keeps stakeholders trusting and helps them solve problems faster.

With mobile access, teams can check their financial status remotely, reducing delays. Updates on financials keep everyone in the loop.

Incentivise Early Payments

Incentives speed up cash collection while keeping clients happy. It's often cheaper to pay early than to borrow or collect in the short term. Structured discount programs encourage clients to pay on time without straining the budget. Late payment penalties motivate people to pay on time while covering administrative costs.

Teams should clearly communicate payment policies early and set proper expectations. Reward programs for consistent early payment build long-term client loyalty. Innovative incentive structures improve payment behaviour while protecting profit margins and cash flow stability.

Provide Multiple Payment Methods

The best payment systems prevent mail delays, reduce processing costs, and eliminate mail delays. Online payments are easy with automatic receipts and mobile approvals.

Integrating these modern payment methods with accounting systems gives you precise tracking, boosts customer satisfaction, and optimises cash flow.

Pivot to Long-Term Financing

It's easier to execute projects with cash reserves. Credit lines come in handy for slow payments or unexpected expenses. Long-term loans typically offer better interest rates than emergency borrowing or credit card advances.

Strong bank relationships help you weather temporary cash shortages and keep vendors paid. Building trust with lenders increases credit availability. Flexible financing options make managing cash flow easier. Strong financial relationships make your business more stable and grow faster.

Build Better with Smart Cash Flow Solutions from Access Coins

The key to a successful construction operation is managing cash flow.

When contractors implement the right tools and processes, such as an end-to-end construction ERP platform, they turn cash flow challenges into opportunities for growth and stability.

Get your construction cash flow back on track. Access Coins helps contractors and builders optimize their finances with real-time visibility and powerful forecasting.

Let our industry-leading platform keep your cash flow strong while you deliver exceptional projects.