Why is payroll so complex for many multi-entity businesses?

The reason why is because not only are multi-entity business required to report payments to the ATO from each of their separate entities, but for many, their payroll solution isn’t up to the task.

Traditionally, payroll software has been designed around a single database or instance to manage processing as a single entity. It therefore doesn’t sufficiently cater to those businesses made up of separate employing businesses.

The nuances within separate ABN entities make using these traditional payroll solutions extremely challenging. Their payroll teams are burdened with repetitive tasks, as well as the separation of data, processes, roles, and rules when processing pay runs, STP reporting, Super Funds, and General Ledger feeds into finance systems. Much of this processing overhead could be optimised for a much-improved experience all round.

How can multi-entity businesses simplify payroll?

To help multi-entity businesses better understand and overcome their unique payroll challenges, Access has created an executive brief that explores how they can remove the complexity from processing payroll.

Download ‘The Payroll Challenge for Multi-Entity Business’ today to gain a clear understanding of the obstacles multi-entity businesses face during the three stages of the payroll process, including:

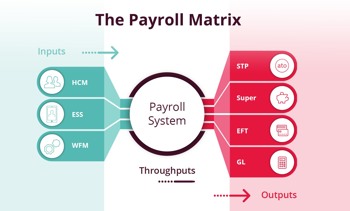

- Inputs: The third-party applications that feed into payroll software, and the rules which govern them.

- Throughputs: The configuration, administrative and processing touchpoints with every pay cycle, which increase the complexity for payroll teams, and the costs for their business.

- Outputs: The need to ensure employees are paid accurately and on time, which entails producing payslips, files for government bodies, superannuation contributions, and meeting reporting obligations.

Finally, we explain how true multi-entity payroll software can help businesses overcome these challenges, providing a detailed breakdown of the benefits that can empower your business to simplify payroll and ensure your employees are paid accurately and on time.

UK

UK

SG

SG

MY

MY

US

US

IE

IE