More than 8,000 accounting practices - from small boutiques to the Big Four - can’t be wrong

For Accountants time is money, so here is everything you need to know, fast

All your tax and compliance taken care of

We believe that Accountants are too important to be held back by complexity and compliance. What we hear consistently from thousands of customers is that there is so much technology, too many systems, and not enough staff.

Our software aims to solve some of these challenges by delivering everything you need in one suite, from a single provider. What's more, we don't care what bookkeeping applications your clients are using – we'll work with what you’ve got.

All-in-one practice solutions

Running a successful accounting practice requires a lot of things to be working well, together. While we can’t control tax law changes, or find you the best talent in the market, we can help you with your practice management software.

When it comes to managing clients, jobs, tracking time and optimising resources, we’ve got you covered.

Turn your advice into profit

Once your compliance, tax and practice management are taken care of, that opens a whole host of possibilities and time to do more. That’s where value-added services for your clients come in.

Advisory is nothing new for Accountants – we know it’s your bread and butter. But what if it could be easier to implement, deliver and scale for your clients, and allow you to charge accordingly for your valuable advice?

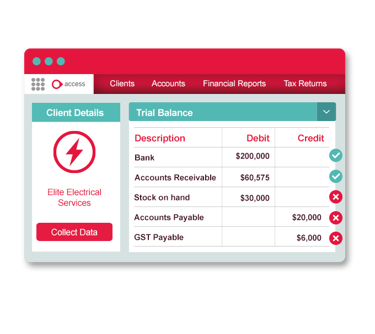

Get more from your valuable client data

Your client data is only as good as your ability to access, analyse and use it. With our API you can connect to all the major small business accounting applications you need.

Store and prepare this data safely in our data warehouse and then connect it to our compliance applications to help complete period-end and year-end compliance work for clients.

Say goodbye to rekeying data (and the mistakes that can happen), and lodge tax returns faster and with greater accuracy.

Everything you need, under one roof

Run your entire practice with best-in-class powerful tax, compliance, practice and advisory software. We’re here to help you work more efficiently, deliver a better experience to your clients, and give your teams the tools to make the most out of every minute.

Hear from some of our customers who utilise Access Software for Accountants to power their accounting practice

Our accounting practice software

Access Accountants Evo

A complete cloud suite, no matter the size of your practice.

APS Evo

A complete suite for larger ANZ firms with more than 20 employees, available on-premise or online.

HandiSoft Evo

A complete suite for small to medium size practices available on-premise or online.

Elite Evo

For sole practitioners and growing practices available on-premise or online.

ChangeGPS

Software for your practice and compliance advisory—for accountants of all sizes.

Fathom

A single platform purpose-built for business advisors and trusted by leading advisory firms worldwide.

Accounting practice management resources

Looking for accounting practice software but don't know where to start? Our curated resources make finding the right software easy.

Accounting practice software FAQs

What software do accounting practices use?

Although every accounting practice is different, with each practice having different challenges and clients, most of them will use the following software for accountants to power their practice:

- Tax software - enabling practices both small and large to prepare, manage and lodge tax returns for their clients

- Ledger software - where practices can manage client ledgers, create professional, practice branded financial and management reports for their clients

- Practice Management - which can be used to run all aspects of a practice to improve client experience and increase productivity

- Data Management and Analytics - which helps practices make important data-driven decisions due to the wealth of empowering data and insights

Why accountants choose Access software?

The main reasons accountants choose Access software for accountants:

- We have been creating trusted and proven practice software for accountants since 1988.

- Processes more than 40% of all agent prepared individual tax returns.

- Is trusted by more than 8,000 accounting practices across Australia and New Zealand.

- Is smart, scalable and purpose-built for accountants.

- Offers a client-centric design to provide quick access to all client information from the one place.

- Can be measured by accuracy, timeliness, and customer satisfaction.

- Is supported by experienced professionals based in Australia.

- AI enabled software allows users to ask questions of data in a secure way.

UK

UK

SG

SG

MY

MY

US

US

IE

IE