Tax preparation and lodgment software for accountants

Prepare, manage and lodge tax returns for all your clients.

Accountants both small and large lodge millions of returns each year using Access tax software to streamline their tax return process.

Tax software built for accountants in Australia and New Zealand

Our solutions are built the way accountants like to work. View multiple tax returns at the same time, built-in validation for errors, easily navigate between worksheets and the main tax form. Automatic data flows from worksheet to the main tax form for faster and accurate filing.

Fast and powerful tax software trusted by accountants

A trusted tax solution partner

Access tax and compliance solutions lodge millions of tax forms every year! From activity statements, FBT and tax returns to agent reporting, there are over 30 years of experience and development behind our compliance solutions – so you’re in good hands.

The compliance solution trusted by more than 8,000 accounting practices.

Drive efficiency with pre-filled tax returns and activity

Speed up compliance work by automatically prefilling activity statements and your client’s income and deductions in individual tax returns with data from the ATO. Freeing up your time to focus on value-add services.

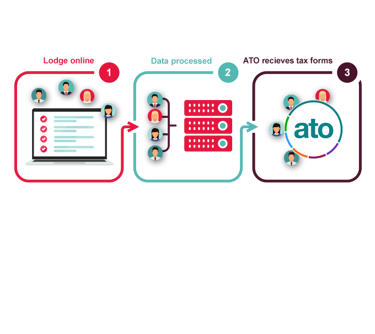

Connect to the ATO and lodge tax forms online

Our tax forms are updated each year based on the latest compliance legislation from the ATO. Lodge your clients tax returns for individuals, companies, partnerships, trusts and SMSF’s along with activity statements and FBT returns directly from the software.

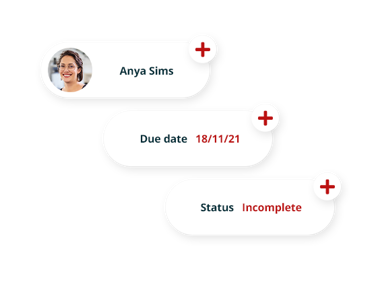

Manage your workflow and track the status of work

Build a custom workflow to help you streamline the end-to-end lodgement process for your clients including assigning employees, due dates and the status of returns. Improve your practice on-time lodgement and ensure your core compliance work is streamlined and efficient.

Customers who utilise Access tax software for accountants

Keep up to date with the latest Accountant Information

Visit our Accountants hub and blog for the latest research, best practices and industry specific insights.

For all your accounting practice needs

Run your entire practice with best-in-class powerful tax, compliance and practice management software to help optimise compliance workflows and advance every aspect of your accounting practice. Our solutions offer powerful, automated workflows, out of the box dashboards and easily customised reporting, enhancing productivity and providing you with instant access to data-driven insights.

Tax preparation and lodgment software for accountants FAQ

What software do accountants use to file taxes?

40% of all practitioner prepared individual tax returns are lodged through Access HandiTax.

HandiTax Cloud is tax software designed with busy tax agents in mind, enabling fast and powerful tax preparation and lodgement in the cloud through a simple user interface that is intuitive and easy to navigate.

Here at Access we have helped thousands of accounting practices to choose the right tax software.

What is a Tax preparation and lodgment software?

Tax preparation and lodgement software is built to make the lives of busy accounting professionals easy, by providing effortless tax lodgement.

Tax software allows accounting professionals to prepare, lodge and track tax returns from anywhere at anytime on a compatible device.

It is designed to make tax returns faster and more accurate, streamlining the process for accountants both small and large who lodge millions of returns each year.

Read our guide for more information on implementing new tax software for your accounting practice.

Why choose Access tax sofware over our competitors?

Access tax preparation and lodgment software:

- Has been creating trusted and proven tax software for accountants since 1988.

- Processes more than 40% of agent prepared individual returns each year in Australia.

- Is trusted by more than 8,000 accounting practices across ANZ.

- Is smart, scalable and purpose-built, adapting to the changing demands of growing organisations.

- Can be measured by accuracy, timeliness, and customer satisfaction.

- Is supported by experienced professionals based in Australia.

- Is processed and managed in Australia.

How does a Tax preparation and lodgment software work?

Every tax software in the market works differently but most of them will work something like this:

- Auto save and error check as you complete returns.

- A Report Builder to help you create meaningful reports to help run your practice better.

- Easily split interest, dividends and managed fund distributions by transferring details between returns.

- A workflow that allows you to remain in control to review and lodge while out of the office.

- Data transfer directly from an accountants ledger.

- ATO prefill to save you time.

- Powerful full text search capabilities.

- Rules to ensure only valid values are entered, reducing likelihood of errors.

- Links to Tax Agent help.

- Forms automatically prefilled via ATO SBR technology.

HandiTax Cloud delivers a variety of powerful capabilities to help you grow your practice with powerful, fast tax preparation and lodgement.

What are the benefits of accounting practice tax software?

Accounting practice tax management software benefits practices by:

- Giving full visibility on all your client tax returns.

- Integrating with other accounting practice software for a complete practice solution.

- Saving your practice valuable time in the process of lodging returns.

- Preventing costly mistakes for your practice.

- Maximising your efficiency during the busy tax season.

UK

UK

SG

SG

MY

MY

US

US

IE

IE