Tax and ledger compliance software for accountants

We provide a consistent accounts and tax preparation process for all your client accounting needs from one platform with seamless workflows from accounting through to the tax return without having to rekey any data.

The combination of our integrated data collection, ledger, tax preparation and lodgment software provides you with single platform to perform all your compliance work in the one place.

Client accounting software trusted by more than 8,000 accounting practices across Australia and New Zealand

Smart, scalable tax and ledger software to run your accounting practice

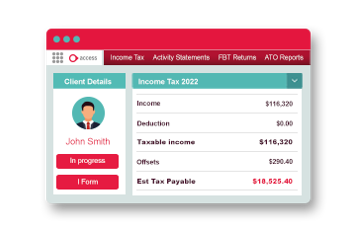

Tax and compliance solutions

Access tax and compliance solutions lodge millions of tax forms every year! From activity statements, FBT and tax returns to agent reporting, there are over 30 years of experience and development behind our compliance solutions – so you’re in good hands.

Tax preparation and lodgment

Grow your practice with powerful, faster tax preparation and lodgment.

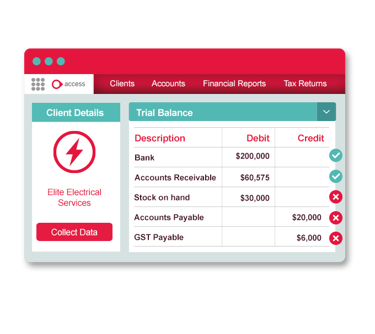

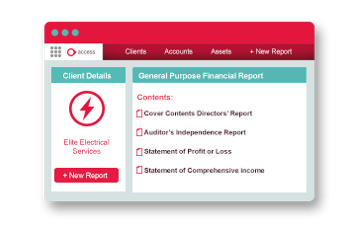

Ledger and reporting

Powerful and efficient tools for producing standardised financial reports for your clients.

Data collection

We connect to all the major small business accounting applications via API to collect, store and prepare the data for analysis in a data warehouse. This provides your practice with all your client data in the one place.

Customers who utilise Access client accounting software

Keep up to date with the latest accountant’s information

Visit our Accountants hub and blog for the latest research, best practices and industry specific insights.

For all your accounting practice needs

Run your entire practice with best-in-class powerful tax, compliance and practice management software to help optimise compliance workflows and advance every aspect of your accounting practice. Our solutions offer powerful, automated workflows, out of the box dashboards and easily customised reporting, enhancing productivity and providing you with instant access to data-driven insights.

Compliance software for accountants FAQs

What is compliance software for accountants?

Compliance software for accounting practices usually includes two components:

- Tax software - enabling practices both small and large to prepare, manage and lodge IAS, BAS and tax returns for their clients

- Ledger software - where practices can finalise accounts and create professional, practice branded financial and management reports for their clients

Compliance software for accountants is designed to help accounting practices complete their legal obligations to both the ATO and for their clients.

What problems do compliance software solve for accounting practices?

Tax and Ledger compliance software for accountants can:

- Save time with smart automation, cross-fill and pre-fill capabilities.

- Enable your practice to perform all compliance work in the one place, with integrated data collection, ledger, tax preparation and lodgement software.

- Support your practice as it grows, with solutions that cater for both small and larger accounting practices.

- Grow your practice with powerful, faster tax preparation and lodgment.

- Produce standardised financial reports for your clients.

- Provide your practice with all client data in one place.

Why choose Access compliance software for accountants?

Access compliance software for accountants:

- Has been creating trusted and proven practice software since 1988.

- Processes more than 40% of agent prepared individual tax returns in Australia.

- Is trusted by more than 8,000 accounting practices across ANZ.

- Is smart, scalable and purpose-built, adapting to the changing demands of growing organisations.

- Can be measured by accuracy, timeliness, and customer satisfaction.

- Is supported by experienced professionals based in Australia.

UK

UK

SG

SG

MY

MY

US

US

IE

IE