Leading cloud-hosted construction accounting

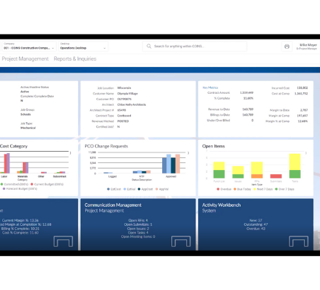

Transformative construction accounting on the cloud. Accessible from anywhere, your data is hosted securely, with access control to keep sensitive data safe. Cloud construction accounting enables purchasing and payment transactions to be processed within a single portal and automates financial management processes across a business.