What is a Construction Bond? A Guide for Contractors

A construction bond is a type of surety bond used across the construction industry to ensure construction projects are completed and protect all parties involved from financial loss.

The various types of construction bonds guarantee the completion of a project and involve a signed agreement between the project owner, a contractor, and the surety company.

This guide outlines the different types of construction bonds, why contractors need a construction bond, the requirements of a construction bond, and how to secure one as a contractor.

What is a Construction Bond?

A construction bond is a type of surety bond used in the construction industry to protect everyone involved in a construction project from financial loss and guarantees that all parties involved accomplish what is agreed upon.

Construction bonds are most common for government and city construction projects, such as school buildings, airports, government buildings, and libraries.

Construction bonds are important for construction contractors because it allows them to access access large-scale projects that are often associated with a construction bond. Construction bonds also provide assurance that a contractor will get paid, including subcontractors.

Construction Bonds: Key Takeaways

- Construction bonds are a type of surety bond used to protect contractors and project owners from financial loss.

- There are various types of construction bonds, but all guarantee that a construction project will completed.

- The three parties involved in a construction bond are the principal, the obligee, and the surety.

- Construction bonds are important because they offer financial protection and mitigate risks involved in a construction project.

- The requirements for a construction bond depend on the type you want, but general documents to submit are financial documents, a past reference on any work with a previous bond, and a proven track record.

Access Coins ERP is built for construction

Gain the competitive edge with a powerful end-to-end platform built for construction management.

How Does a Construction Bond Work?

Construction bonds involve three parties: the Principal, the Obligee, and the Surety.

1. The Principal

The principal is the contractor who purchases the bond and is responsible for the construction itself.

For example, let's say an elementary school is going to build an adjacent building to the library that costs an estimated $5 million. The principal (contractor) must submit a bid for the project and, if selected, provide one of the types of construction bonds to the obligee (project owner) who is funding the project.

The principal (contractor) must build the elementary school building according to the signed contracts. The principal must also purchase the bond from the surety company and pay a premium for the bond, ranging from less than 1% to 3% of the contract value.

In this example, the principal would buy the bond at a 2% rate, bringing the total price of the construction bond to $5,100,000.

2. The Obligee

The obligee is the project owner who requires the bond for the project. Their responsibility is to accept bids from contractors, select one, and ensure the project is complete. The obligee can file a claim with the surety if the contractor fails to fulfill his agreed-upon responsibilities.

3. The Surety

The surety is the bonding company that issues the bond and guarantees financial protection for both the contractor and project owner, as well as the contractor's performance. The surety company guarantees the project's performance and payment. In return, it charges the bond premium.

The surety company steps in if the contractor fails to finish the project, or pay any subcontractors.

Why do Contractors need a Construction Bond?

Construction bonds offer several advantages for both contractors and project owners, including financial protection, risk mitigation for both parties and shared legal protection.

Another advantage is that the contractor must meet high-quality standards. A construction bond also increases transparency and offers more business growth opportunities for both parties.

Financial Protection

Construction bonds protect contractors from being financially responsible if something goes wrong that is not under their control. A bond also allows the contractor to focus solely on completing the construction and not worry about financial matters such as payments, disputes, or penalties.

For project owners, a construction bond offers protection. The bond will cover the project's costs and ensure another contractor is replaced in case the current contractor doesn't fulfill its responsibilities.

Risk Mitigation and Legal Protection

A construction bond will offer risk mitigation to both parties, mainly by preventing financial loss and legal disputes over payment during the construction.

Since most construction bonds are for government and public work projects, there are legal clauses built into the bond that both the contractor and project owner must abide by. This ensures the contractor meets high-quality standards to complete the project and stays accountable for the outcome of the construction.

Transparency

With a construction bond, the relationship between the project owner and the contractor is transparent. Both know what each is responsible for.

Construction bonds provide both parties with clarity on the details of the project, such as administrative tasks like payments, schedules, and the scope of work. Knowing both parties are protected by the construction bond, both can focus on collaborating rather than worrying about any risks.

Business Growth and Opportunities

One key advantage for both contractors and project owners is the business growth and opportunities that can come from using a construction bond. Contractors who take on bonded projects can be seen as reliable and established, able to complete the construction project in a timely manner and within high-quality standards.

Contractors involved with a bonded project can stand out from competitors, take on projects that are highly coveted, and work with reputable owners.

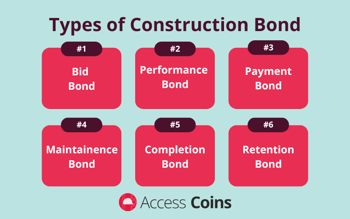

Types of Construction Bonds

There are various types of construction bonds that protect project owners and contractors from financial risks. Each type of construction bond serves a different purpose and has different payment structures for the contractor.

Bid Bond

A bid bond is a typical construction bond and is most commonly used to guarantee that the contractor who takes on the bond will complete the project.

This type of bond protects the project owner and contractor from any financial risks if either party backs out. Specifically, if the contractor doesn't complete the project, the surety company will compensate the project owner for any additional costs and find a new contractor for the project.

A bid bond takes a percentage of the total cost of the project as payment.

Performance Bond

A performance bond ensures that the contractor completes the construction project according to the contract terms and details, such as specifications and the set timeline.

It also ensures that the project is completed no matter what. If the contractor defaults on the project or fails to deliver it in its entirety, the surety company will complete the work or compensate the project owner.

Payment Bond

A payment bond guarantees that the contractor is responsible for paying all the subcontractors, laborers, and materials and supplies for the project. This ensures minimal risk to the project owner and protects them from any payment disputes between the subcontractor and the project owner that can arise.

Maintenance Bond

A maintenance bond ensures that the contractor provides a warranty on the construction work and is responsible for any maintenance for a set period of time. For example, if a contractor completes work on a government building, they could also be responsible for any maintenance issues that come up within a two-year period at no extra cost.

This type of bond provides a security net for project owners and can possibly save them money by having a contractor on board for any issues that arise after the project is complete.

Completion Bond

A completion bond guarantees that the project will be completed, even if the original contractor fails to complete the work. This ensures that the surety company will provide another contractor to finish the work. Completion bonds are common with large-scale and high-risk projects that have a lot of investment in them.

This differs from a performance bond, which guarantees that the contractor will complete the work, versus a completion bond, which guarantees that the project itself will be completed.

Retention Bond

A retention bond is commonly used in large-scale projects and often at the request of the project owners. Contractors use a retention bond to offer up as a form of payment insurance instead of having the project owner withhold part of the contractor's payment during the project.

This ensures the contractor gets paid all at once, with the project owner having some guarantee that if any issues arise or the project isn't complete, the bond can be used for this instance.

It is a guarantee for both the project owner and contractor, so payment is made right away, and the owner has a guarantee that a project will be completed properly and has insurance in case something goes wrong.

What are the Requirements for a Construction Bond?

The requirements for a construction bond depend on the type of bond a project owner is seeking and what the surety company requires from the principal and obligee.

General requirements for a contractor to secure a construction bond include:

- Business and financial documents

- A proven track record

- Proof of liability

- Payment

Business and Financial Documents

The surety company will assess the contractor's financial statements, tax returns from previous years, credit history, and bank references. The surety company will then use this to determine a contractor’s standing.

A Proven Track Record

Any surety company will want to know if the contractor has a proven track record of completing construction projects successfully and if they have experience with construction bonds. Any references that will help secure a bond should be given at this stage.

Proof of Liability

Construction contractors should be able to provide proof of liability and any insurance paperwork to show they are covered by an insurance provider. The surety company will ensure contractors who receive construction bonds, have the necessary insurance to show they are covered in case of any accidents or damage during the project.

Payment

Once the surety company reviews and evaluates all the financials and documents provided, contractors will pay the premium. The premium is a percentage of the bond and typically ranges between less than 1% and 3% of the total contract.

Access Coins keeps all of your construction data in one place

Construction ERP helps general contractors and specialty contractors find the documents and information they need in seconds.

How to Secure a Construction Bond

Securing a construction bond as a contractor involves several steps, including working with a surety company to ensure they can submit a bond application to establish a relationship with project owners.

- Determine the construction bond you need

- Find a surety company

- Prepare financial documents

- Submit your bond application

- The underwriting process begins

- Review and sign the bond agreement

- Pay the bond premium and begin construction

Once contractors have determined the type of construction bond they need, they will need to prepare financial documents, which will be assessed by the surety company. This is to ensure the contractor has financial stability and a clear credit history. The surety company will also seek a proven track record of completing projects.

The next step is for contractors to submit a bond application that will detail their business information, the scope of the project, and the bond amount. Once the application is submitted, the surety company will review, and the underwriting process begins. This is where the surety company will either approve or deny the application.

If all goes well, the contractor will review and sign the bond agreement, pay the bond premium, and begin construction on the project.

UK

UK

AU & NZ

AU & NZ

SG

SG

MY

MY

IE

IE