Accounting vs. bookkeeping

Bookkeeping refers to the process of recording all your financial transactions, also known as financial statements. It helps to keep track of your transactions on a daily basis so that your accounts are up to date. Accounting is more than that. It also involves organising and analysing the recorded data to derive actionable insights for your business. Accounting can be done manually, typically using a spreadsheet, outsourcing to an accountant or accountancy firm, or using accounting software.

Cash basis vs. accrual accounting

There are two approaches to accounting to choose between – cash basis accounting and accrual accounting. In the former, you only record revenues when money is received and expenses when money is paid. In the latter, you record revenues and expenses from the moment invoices are raised or received. Here’s an example of both approaches in action:

Imagine you run a business that sells specialty coffee beans. A business customer places a $2000 order. You create an invoice and send it to them. Under the cash basis approach, you will record $2000 of revenue earned only when the customer makes payment. Under the accrual approach, you will record the revenue as soon as the invoice is raised.

On paper, there isn’t much of an issue, as long as your customer pays. However, from a cash flow perspective, your accounts would show that you have $2,000 revenue from the invoice but your bank account wouldn’t reflect the same until the payment is made.

The same applies to expenses. Imagine you place a $1000 order for coffee beans from your supplier. Under the cash basis approach, you’ll only record it as an expense incurred when you make a payment. Under the accrual approach, you will record it as an expense the moment you receive the invoice.

There are advantages and disadvantages to both. Which approach you choose depends on your preference and what you think best fits your business. But in general, small businesses tend to use cash basis accounting because it is simpler.

Three main financial statements

Every financial statement of your business enters what is called a general ledger. In this ledger, there are 3 main financial statements that you need to know and use: the Balance Sheet, the Income Statement, and the Cash Flow Statement.

What is a Balance Sheet?

A balance sheet contains records of your business’s assets (what you own), liabilities (what you owe), and equity (the amount of assets left for shareholders after all liabilities have been settled) at a specific point in time. The simplest way of expressing the balance sheet is through this formula:

Assets = Liabilities + Shareholder’s Equity

As the name implies, both sides of the equation should balance out. If they don’t balance out, it indicates that there’s an error on either side and it’s important to identify where the discrepancy lies so that your accounts are accurate.

There are no hard and fast rules as to which items you need to include in your balance sheet. For example, if "Property & Equipment" is relevant to your business, you can include it under your current assets.

You might have also noticed that the example uses the accrual basis accounting approach – "Debtors Control" and "Creditors Control" money owed to you in the former, and money you owe in the latter. Under the cash basis approach, these 2 items will not be included in the balance sheet because they contain money that has yet to be received or paid.

Balance sheets are generally used alongside the other 2 financial statements, but by themselves, they can be used to give anyone a quick overview of your business’s financial health. In general, your assets to liabilities ratio, if applicable, should see improvements per quarter or year because it is a sign of your business being in good financial health and is experiencing healthy business growth.

What is an Income Statement?

An income statement, also known as a profit and loss statement, tracks the revenues and expenses of your business during a period of time. Under the cash basis accounting approach, an income statement is the same as a cash flow statement.

Again, there are no hard and fast rules as to which item to include in an income statement or the timeframe to set. You can track it by year, quarter, or even month. Likewise, how granular you wish to go into for each item is up to you. For example, instead of just listing “Salary” under “Expenses”, you can detail the actual breakdown of it, employee by employee.

As the name implies, the Income Statement helps give you an idea of the profitability of your business. Income statements can be used to compare your business’s performance over different time periods to optimise your business and forecast future revenues among other things. For example, you can test a new marketing strategy across 3 months and compare your business’s income statement for that 3 months with that of the previous 3 months to evaluate its effectiveness.

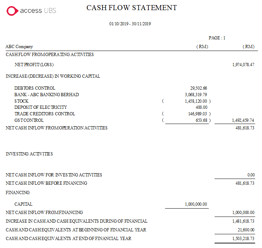

What is a Cash Flow Statement?

A cash flow statement tracks the inflows and outflows of your business’s cash in a given period. In short, it tracks the actual current cash situation of your business.

If you’re planning to go with accrual basis accounting, the cash flow statement is invaluable as it tells you exactly how much liquidity your business has which in turn helps you to make better business decisions. For example, if there is too much cash on hand, you may consider increasing expenditure on areas such as marketing and equipment to improve your business’s growth. If there's limited cash and short-term liabilities to be met, you may consider cutting back on expenditure accordingly.

How Access can help

When your budget is tight and the scale of your operations is small, manually doing the accounting of your business yourself may be the most viable solution. However, this comes at the expense of much time and toil. Using an accounting software to maintain your accounts will free up much of your valuable time and energy through streamlining the whole accounting process and ensuring accurate reporting to your local tax authorities; benefits that grow exponentially in size as your business grows.

Regardless of where your business stands, you will greatly benefit from switching to an accounting software solution such as Access UBS that is always up-to-date with various local legislations. In fact, 64.4% of small business owners use accounting software.

With Access UBS, much of your accounting process will be automated and accurate, which frees up your time and energy to focus on growing your business.