For SMEs, this transformation presents both opportunities and challenges. Navigating compliance, streamlining finance processes, and adopting new technologies can feel daunting—especially when resources are limited. But future-proofing is possible with the right approach and tools.

The shift to eInvoicing: What SMEs need to know

The objective of eInvoicing is to standardise and digitise invoicing across Malaysia, enabling real-time validation of transactions.

For SMEs, this means traditional manual invoicing methods—often paper-based or spreadsheet-driven—will no longer suffice. Instead, businesses will need systems that can generate and transmit invoices electronically, with direct submission to LHDN for verification.

Implementing a compliant eInvoicing solution with advanced technology such as Access UBS Evo early on can help businesses avoid last-minute disruptions, reduce administrative burdens, and ensure smooth adoption when the mandate becomes universal. To learn more on how eInvoicing through Access UBS Evo, click here. - Access UBS Evo eInvoicing

Addressing common financial challenges

Many SMEs continue to face longstanding finance-related challenges, such as:

- Manual and error-prone workflows: Time-consuming processes for invoicing, payment tracking, and reconciliation increase the risk of human error and reduce operational efficiency.

- Limited visibility: Disconnected systems or reliance on spreadsheets make it difficult to gain a clear, real-time view of cash flow, profitability, and outstanding liabilities.

- Compliance complexity: Keeping up with tax regulations, SST reporting, and now eInvoicing requirements adds pressure to already stretched finance teams.

- Resource constraints: Smaller businesses often lack the dedicated IT or finance staff needed to support large-scale digital initiatives.

A modern financial management system can address these issues by introducing automation, improving accuracy, and integrating regulatory requirements into daily workflows.

Check out how Access UBS Evo addresses these financial challenges with its AI-powered capabilities in the video: Magic Moments Video >>

The role of mobile-friendly, scalable solutions

For modern SMEs, mobility is no longer a convenience—it’s a necessity. Finance teams and business owners increasingly require the ability to manage financial tasks on the go, whether attending meetings, visiting clients, or overseeing operations across multiple locations. Mobile-friendly finance solutions provide flexibility, enabling real-time access to critical financial data anytime, from any device.

Key features to look for in a finance solution include:

- Built-in eInvoicing compliance aligned with Malaysia’s LHDN requirements.

- Automation of recurring tasks such as invoice generation, payment reminders, and tax calculations.

- Customisable dashboards and reporting tools for improved financial visibility and decision-making.

- Scalability to support business growth without the need to switch systems.

This level of accessibility helps reduce delays in decision-making, increases operational agility, and supports faster response times—especially important in dynamic or resource-limited business environments.

Scalability further enhances these benefits. As a business grows, its financial processes must adapt without becoming more complex or time-consuming. Scalable finance tools ensure that increased transaction volumes, additional users, and evolving compliance needs can be managed with ease, without overburdening internal teams.

Getting ahead of the curve with AI-driven finance

For SMEs looking to not only comply but thrive in a digital-first economy, adopting AI-enabled finance tools can be a game-changer.

Modern financial systems equipped with AI go beyond automation. They can intelligently classify transactions, flag anomalies in real time, and even forecast cash flow based on historical data and spending patterns. This level of insight helps business owners and finance teams make proactive, data-informed decisions rather than reactive ones.

The Access Group recently has conducted a survey to identify how AI impacts organisations and their teams - in the UK. The study generated 1,134 responses from employees across 12 industry sectors, and the results showed that half of those surveyed have adopted AI at work with staggering 93% saying the impact has been positive. You can download the full report here – AI at Work: The powerful impact of AI on workplace behaviour

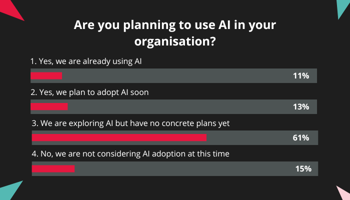

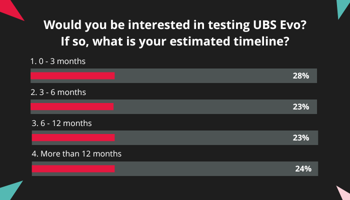

Another survey that we did on our recent Access UBS Evo webinar with over three thousand attendees shows that 58% of the respondents are either already using AI or planning to adopt AI into their business and 74% indicated that the adoption will be happening in the next 12 months.

The survey also revealed that the digital transformation is happening at a rapid pace and soon, nobody will be exempted from making the changes. With the notion to help you staying relevant, you may visit our one-stop information hub to access all our previous webinars and learn more about Access UBS Evo and eInvoicing: Customer Lounge and On-demand Content Hub

Conclusion

The digitalisation of tax reporting and invoicing is no longer a distant prospect—it’s an immediate reality for Malaysian SMEs. Embracing it with the right financial tools can transform compliance from a burden into a strategic advantage.

By simplifying workflows, increasing visibility, and aligning with LHDN’s eInvoicing framework, SMEs can lay a strong foundation for sustainable growth in a digitally driven economy.

Interested in getting onboard with adopting AI and transforming your accounting journey with Access UBS Evo? Find out which plan suits you best - Access UBS Evo Plans